An Alabama LLC operating agreement allows the company members to record their ownership interests. It also includes the roles, management, and structure of how it should be run on a day-to-day basis. After all company members sign, the agreement will be legally binding to the parties involved. After completion, the form is held by each member; it is not filed with the Secretary of State.

By Type (2)

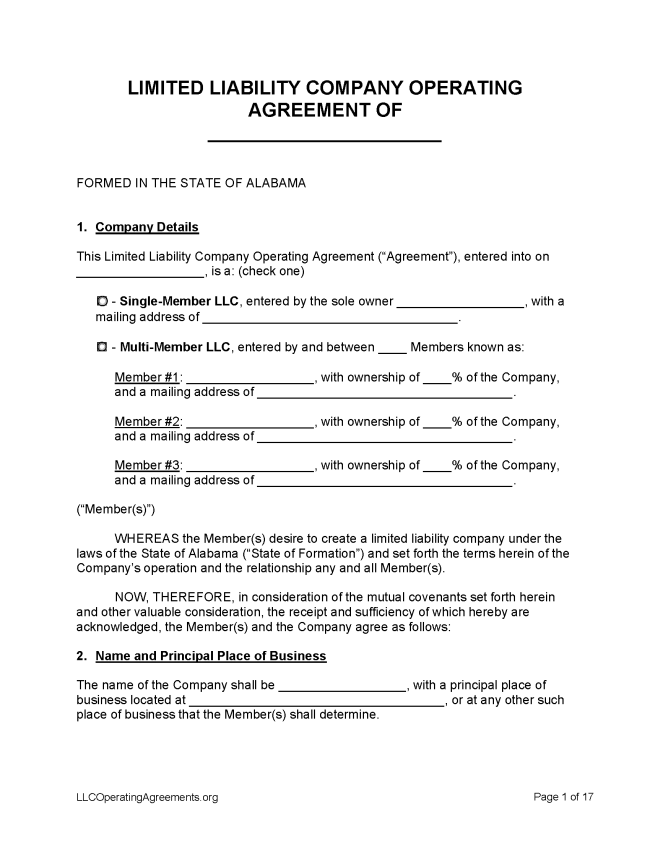

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Alabama

- Filing fee: $208

- Processing time: Immediate

1. Choose an LLC Name

Use the Secretary of State’s database search (choose the option “Entity Name“) to search the business database and see if the name is already registered. If there are no search results, the name is available to use for a new LLC.

2. Decide the Type of LLC

Domestic LLC – For an LLC located within Alabama.

- Online Filing – $208

- Paper Filing (Certificate of Formation) – $200

- Attach 2 copies , a check (for $200), and a self-addressed stamped envelope to Secretary of State, Business Services, P.O. Box 5616, Montgomery, Alabama 36103

Foreign LLC – For a business with a principal office location outside Alabama seeking to do business within the State.

- Online Filing – $150

- Paper Filing (Application for Registration) – $150

- Attach 2 copies , a check (for $150), and a self-addressed stamped envelope to Secretary of State, Business Services, P.O. Box 5616, Montgomery, Alabama 36103

3. Post-Formation

After the LLC is completed processing, it will show in the business database when conducting an online search. After verifying, it is best to complete the following:

- LLC Operating Agreement – Create to establish the ownership interest of all the parties in the entity.

- Federal Employer Identification Number (FEIN) – A tax ID number to open a bank account in the entity’s name.

Name Reservation

If a filer is not ready to create an LLC, the desired name can be reserved for up to 90 days (which can be renewed).

- Online Filing – $28 ($25 for subscribers)

- Paper Filing – $25

- Mail to: Secretary of State, Business Services, PO Box 5616, Montgomery, AL 36103.

Renewing an LLC

Alabama requires an LLC to be renewed through its annual Business Privilege Tax (BPT). This is completed by filing Form BPT-IN provided by the Alabama Dept. of Revenue.

The tax depends on the revenue generated by the LLC. There is a minimum $100 tax. The form is due 3.5 months after the end tax year (so if the tax year ends on Dec. 31, the due date would be Apr. 15).

If the LLC is taxed as a C-Corp, an additional 6.5% tax is paid.

Dissolving an LLC

- Filing fee: $100

The members of an LLC have the right to dissolve and terminate an entity’s existence if all its members agree or if a condition in the operating agreement is triggered to cause the dissolution. (Section 10A-5A-7.02(b))

Domestic LLC

- Articles of Dissolution

- Attach 2 copies , a check (for $100), and a self-addressed stamped envelope to Secretary of State, Business Services, P.O. Box 5616, Montgomery, Alabama 36103.

Foreign LLC

- Certificate of Withdrawal

- Attach 2 copies , a check (for $100), and a self-addressed stamped envelope to Secretary of State, Business Services, P.O. Box 5616, Montgomery, Alabama 36103.

Statutes

- Section 10A-5A-1.08 – Limited liability company agreement – Scope; function; and limitations.

- Section 10A-5A-1.09 – Limited liability company agreement – Effect on limited liability company and persons admitted as members.

- Section 10A-5A-1.10 – Limited liability company agreement – Effect on third parties and relationship to writings effective on behalf of limited liability company.

“LLC Operating Agreement” Definition

LLC operating agreement means any agreement (whether referred to as a limited liability company agreement, operating agreement or otherwise), written, oral or implied, of the member or members as to the activities and affairs of a limited liability company or series thereof. The limited liability company agreement of a limited liability company having only one member shall not be unenforceable by reason of there being only one person who is a party to the limited liability company agreement. The limited liability company agreement includes any amendments to the limited liability company agreement.