A Delaware LLC operating agreement outlines the affairs of a limited liability company (LLC) and the conduct of its business. The agreement sets forth members’ rights and responsibilities, as well as outlining the process for handling financial affairs and company dissolution, among other matters. The document, while not required by state law, is highly recommended as it can alleviate disputes and protect owners’ personal interests from legal liabilities.

By Type (2)

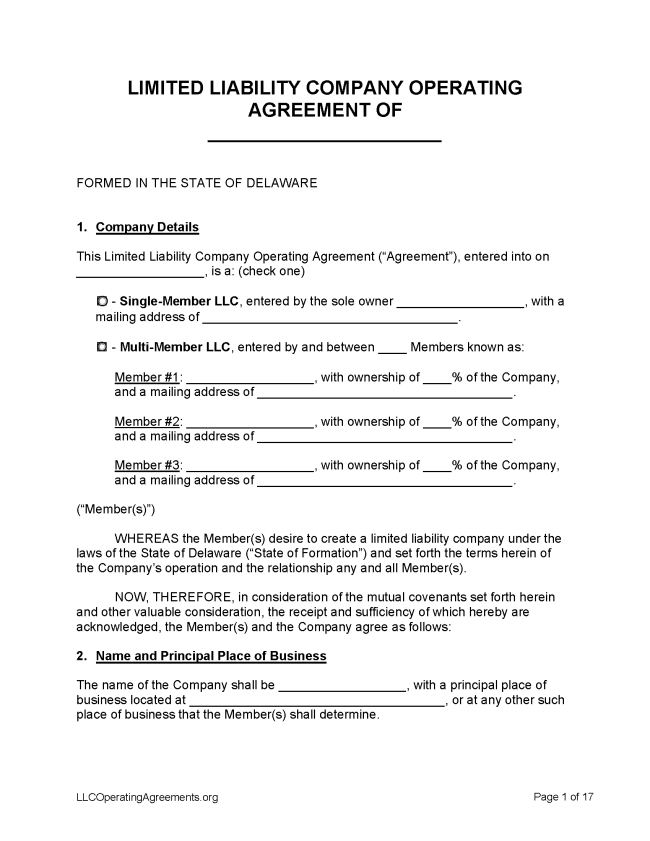

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Delaware

- Filing fee: $90 (domestic LLCs), $200 (foreign LLCs)

- Processing time: 3-5 business days. Expedited service is also available; see the schedule of fees here.

1. Choose a Name

While reserving a name before registering an LLC is not a necessary step, it’s generally advisable. Registration can take time, and while the process is underway, the Delaware Division of Corporations will hold a name for the applicant’s exclusive use. This step can be completed online. Click here to search the database for names that have already been reserved or accounted for, then here to reserve a name. Delaware statute requires that names be distinguishable from the names of LLCs that have already been registered. A name can also be reserved through the submission of a paper application, which should be signed and sent or delivered to the Delaware Division of Corporations, 401 Federal Street, Suite 4, Dover DE 19901.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Delaware.

- Online Filing – While Delaware does not offer an online application, a paper application can be uploaded to the state’s Document Upload Service.

- Paper Filing (Certificate of Formation) – A paper application can be mailed to Division of Corporations – John G. Townsend Building at 401 Federal Street, Suite 4, Dover, DE 19901. Attach the filing fee and a cover sheet bearing the applicant’s name, return address, and phone number, as well as the entity’s name.

Foreign LLC – For an LLC located outside Delaware.

- Online Filing – While Delaware does not offer an online application, a paper application can be uploaded to the state’s Document Upload Service.

- Paper Filing (Certificate of Registration) – A paper application can be mailed to Division of Corporations – John G. Townsend Building at 401 Federal Street, Suite 4, Dover, DE 19901. Attach the filing fee and a cover sheet bearing the applicant’s name, return address, and phone number, as well as the entity’s name.

3. Post-Formation

Once the paperwork has been processed, members should sign an operating agreement and register the entity for tax purposes.

- LLC Operating Agreement – Select the operating agreement above that fits the company’s profile.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $75

A name can be reserved for a period of up to 120 days before the LLC is formed (§ 18-103).

- Online Filing – Click here to search the database for names that have already been reserved or accounted for, then here to reserve a name.

- Paper Filing – A name can also be reserved through the submission of a paper application, which should be signed and sent or delivered to the Delaware Division of Corporations, 401 Federal Street, Suite 4, Dover DE 19901.

Renewing an LLC (Annual Tax)

Filing fee: None

An LLC in Delaware is not required to file an annual report the way other companies are; however, LLCs must pay an annual tax of $300 no later than June 1 each year. Failure to pay this tax will result in a penalty of $200 plus 1.5% interest per month (§ 18-1107).

- Online Filing – Delaware has mandated electronic filing of annual reports. Taxes can be paid by entering the business entity file number here and selecting “Continue.”

Dissolving an LLC

Filing fee: $200

An LLC can be terminated through the filing of a Certificate of Cancellation (§ 18-801).

- Paper Filing (Domestic LLC) – The completed form, filing fee, and a cover letter bearing the applicant’s name, address, and phone number should be sent or delivered to the Delaware Division of Corporations, 401 Federal Street, Suite 4, Dover DE 19901. Checks can be made payable to the Delaware Secretary of State.

- Paper Filing (Foreign LLC) – The completed form, filing fee, and a cover letter bearing the applicant’s name, address, and phone number should be sent or delivered to the Delaware Division of Corporations, 401 Federal Street, Suite 4, Dover DE 19901. Checks can be made payable to the Delaware Secretary of State.

Statutes

“LLC Agreement” Definition

“Limited liability company agreement” means any agreement (whether referred to as a limited liability company agreement, operating agreement or otherwise), written, oral or implied, of the member or members as to the affairs of a limited liability company and the conduct of its business. A member or manager of a limited liability company or an assignee of a limited liability company interest is bound by the limited liability company agreement whether or not the member or manager or assignee executes the limited liability company agreement. A limited liability company is not required to execute its limited liability company agreement. A limited liability company is bound by its limited liability company agreement whether or not the limited liability company executes the limited liability company agreement. A limited liability company agreement of a limited liability company having only 1 member shall not be unenforceable by reason of there being only 1 person who is a party to the limited liability company agreement. A limited liability company agreement is not subject to any statute of frauds (including § 2714 of this title). A limited liability company agreement may provide rights to any person, including a person who is not a party to the limited liability company agreement, to the extent set forth therein.