A Connecticut LLC operating agreement is a form that sets out the ways in which a limited liability company (LLC) will be owned, managed, run, and dissolved. The agreement clarifies matters pertaining to profit and loss, membership interests, transferring membership, and winding up the company, among other matters. It can be an essential tool in case of a legal dispute and can further protect each member’s personal assets from claims lodged in court against the company.

By Type (2)

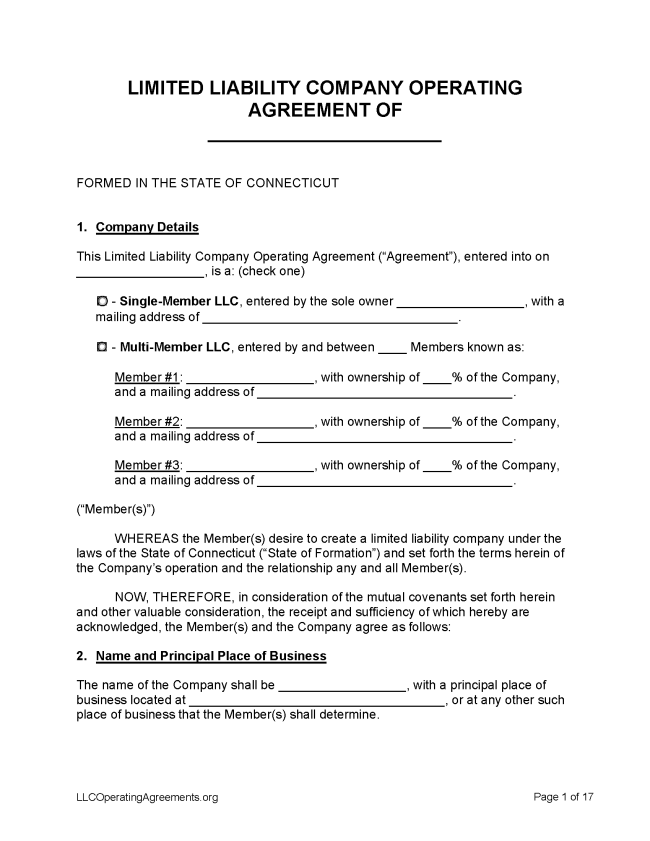

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Connecticut

- Filing fee: $120

1. Choose a Name

The first step in forming an LLC in Connecticut is to choose a name. This can be done online or via a paper form known as the Application for Reservation of Name.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Connecticut.

- Online Filing – Sign up for a ct.gov account, then log into the account and follow the prompts.

- Paper Filing – Fill out the Certificate of Organization by printing clearly in ink, then print and sign it. Enclose filing fee; make checks payable to Secretary of State. If mailing the form, use this address: Business Services Division, Connecticut Secretary of the State, P.O. Box 150470, Hartford CT 06115. If delivering in person, use this one: 165 Capitol Avenue, Suite 1000, Hartford CT 06106. For inquiries, call 860-509-6003.

Foreign LLC – For an LLC located outside Connecticut.

- Online Filing – Sign up for a ct.gov account, then log into the account and follow the prompts.

- Paper Filing – Fill out the Foreign Registration Statement by printing clearly in ink, then print and sign it. Enclose filing fee; make checks payable to Secretary of State. If mailing the form, use this address: Business Services Division, Connecticut Secretary of the State, P.O. Box 150470, Hartford CT 06115. If delivering in person, use this one: 165 Capitol Avenue, Suite 1000, Hartford CT 06106. For inquiries, call 860-509-6003.

3. Post-Formation

Once the paperwork has been processed, several documents must be filed.

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $60

Upon being approved, a name is reserved for the applicant’s exclusive use for 120 calendar days (§ 34-243l).

- Online Filing – Log into the user account, then follow the prompts.

- Paper Filing – Fill out the Application for Reservation of Name, which can be used both for domestic and foreign LLC registrations. If mailing the form, use this address: Business Services Division, Connecticut Secretary of the State, P.O. Box 150470, Hartford CT 06115. If delivering in person, use this one: 165 Capitol Avenue, Suite 1000, Hartford CT 06106. For inquiries, call 860-509-6003.

Annual Report

Filing fee: $80

An annual report is due yearly and can be filed online here. Filing annual reports online is required; entities that do not file these reports will be dissolved automatically.

- Online Filing – Log into user account, then follow the instructions.

Dissolving an LLC

Filing fee: None

An LLC can be terminated through the filing of a Certificate of Dissolution (§ 34-267a).

- Online Filing – Log into user account, then follow the instructions.

- Paper Filing – Fill out a Certificate of Dissolution and send it to the Secretary of State. If mailing the form, use this address: Business Services Division, Connecticut Secretary of the State, P.O. Box 150470, Hartford CT 06115. If delivering in person, use this one: 165 Capitol Avenue, Suite 1000, Hartford CT 06106. For inquiries, call 860-509-6003.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, implied, in a record or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in subsection (a) of section 34-243d. “Operating agreement” includes the agreement as amended or restated.