An LLC operating agreement is a document that includes the company’s ownership, management, and how it functions on a day-to-day basis. An operating agreement is the only document that records the ownership of the entity. Therefore, it is highly recommended that each owner (member) of the LLC have a signed copy of the agreement for their own benefit.

Any changes made in the company should be reflected in an amended operating agreement.

Table of Contents |

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

What is an Operating Agreement?

An operating agreement states how a company is run and its ownership. It states the ownership of each member and the officers’ responsibilities. An agreement should also include specific terms on running the company such as meetings, distributions, capital contributions, and any other business items.

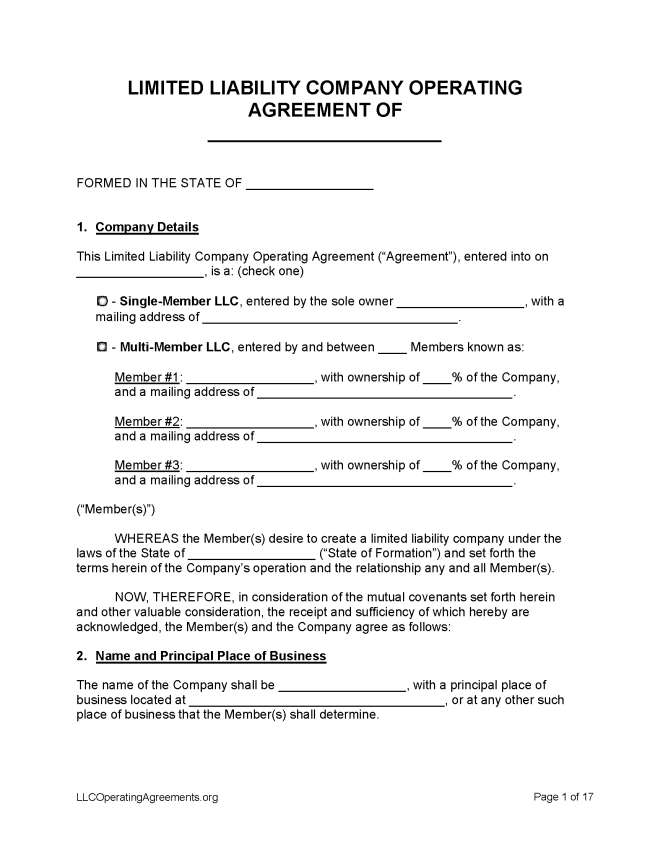

How to Write

Introduction To Agreement

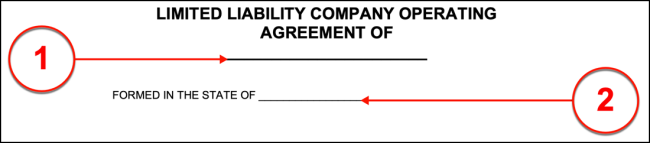

(1) Title. The title of this agreement is currently incomplete. In order to complete this item, furnish the Limited Liability Company’s legal name. This should be the Company that his agreement concerns.

(2) State Of Formation. The State where the Limited Liability Company’s articles of organization were filed should be identified by name on the line attached to the phrase “Formed In The State Of.”

I. Company Details

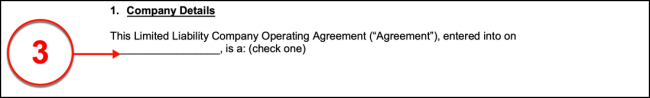

(3) Operating Agreement Date. The calendar date marking when the agreement made here between the Member or Members who shall sign this paperwork and the Limited Liability Company identified in the title should be dispensed the first available space in Section 1.

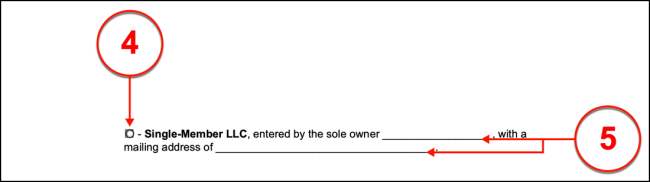

(4) Single Member LLC. Section I must indicate whether the Limited Liability Company in question is entering this agreement with one Member or more than one Member. If only one Member will enter this agreement by signing it, then select the checkbox labeled “Single-Member LLC.”

(5) Sole Owner. After selecting the first checkbox, the full name of the Sole Owner (the Single Member) must be established by recording it on the first line in the “Single Member LLC” option while the mailing address of the Sole Member should be produced on the second blank line of this statement. If there will be more than one Member signing this document, then do not select the first option in Section 1 and leave the empty areas unattended.

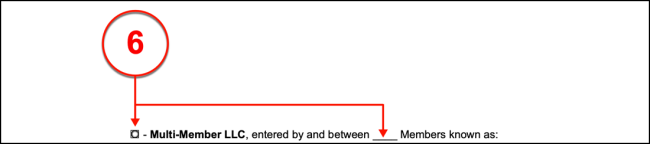

(6) Multi-Member LLC. If there will be more than one Member signing this document and entering the agreement with the Limited Liability Company named above then, select the “Multi-Member LLC” checkbox from Section 1 and define the number of Members that will enter this agreement on the blank line provided. Keep in mind that each Member must be identified in this statement.

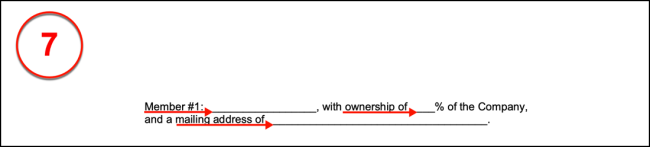

(7) Member Information. This statement assumes that two or three Members will sign this paperwork, so three distinct areas (“Member #1,” “Member #2,” and “Member #3”) have been provided requiring information that must be presented for each Member. Begin with “Member #1,” by supplying his or her full name to the first blank line, the percent of ownership he or she shall have in the LLC on the second blank line then, his or her mailing address on the final blank line.

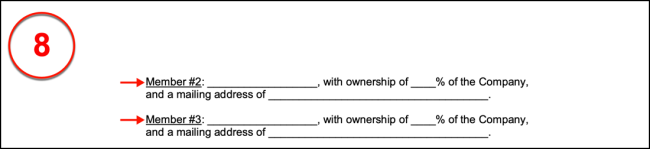

(8) Remaining Signature Members. Record the name, percent of ownership, and a formal mailing address for Member #2 and (if applicable) Member #3 in their respective areas. If more Members intend to enter this agreement with the LLC, then copy and paste one of these statements to this area making sure to designate each Member with a different number.

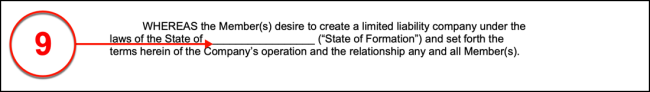

(9) State Of LLC Formation. The final detail required by Section 1 will be the name of the State where the Limited Liability Company (named in the title) officially formed by registering its formation with the appropriate State Government Entity (oftentimes the Secretary of State). Dispense the name of the State where the Limited Liability Company formed in the second to last paragraph of Section 1 where it is requested.

II. Name And Principal Place Of Business

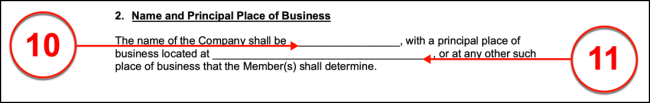

(10) Name Of Company. Solidify the name of the Limited Liability Company behind this agreement by supplying it to the first blank space found in Section 2.

(11) Address Of Limited Liability Company. Produce the Limited Liability Company’s principal place of business (i.e. the main office or headquarters) on the second blank line in Section 2.

III. Formation

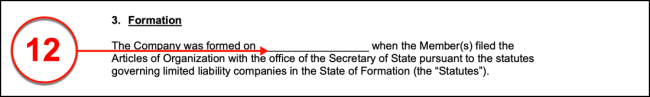

(12) Formation Date. Locate the blank space in Section 3, then supplement the language this section presents by displaying the calendar date when the Limited Liability Company filed its Articles of Organization (with the State).

IV. Members Contribution

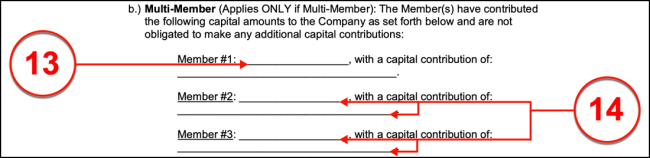

(13) Member Information. The Fourth Section of this agreement will only require attention if this will be a contract between the Limited Liability Company and two or more Members. If so, then furnish the full name of “Member #1” where requested and the exact dollar amount Member #1 contributed to the Limited Liability Company on the blank line following the term “…Capital Contribution Of.”

(14) Multi-Member Information. Continue through the Fourth Section, by satisfying the areas requiring the full name of Member #2 and the amount of money he or she contributed to the LLC then (if needed) do the same for Member #3. Make sure this information is presented for each Member participating in this agreement, even if that Member’s contribution was “0.00.”

XIII. Miscellaneous – Certificates Evidencing Membership

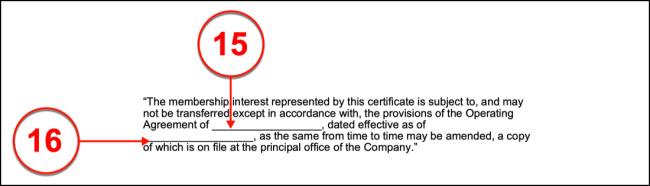

(15) Name Of LLC. If the Limited Liability Company is a Multi-Member LLC, then locate the area labeled “(H) Certificates Evidencing Membership.” Notice a reproduction of the title in this area will require that it is completed with the same information presented in the title of this document. Produce the full name of the Limited Liability Company of this agreement on the first blank space in this area.

(16) Effective Operating Agreement Date. Reaffirm the calendar date of this document’s effect. This must be the same calendar date reported in the First Section.

Member’s Signature Area

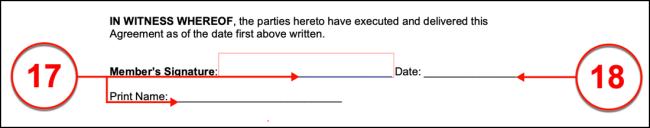

(17) Member’s Signature And Name. Every Member that intends to participate in this agreement may only do so by signing his or her name and displaying it in print in a unique signature area. Several signature areas are available so that every Member of the Multi-Member LLC can sign this paperwork and print his or her name. If this will be a Single Member LLC, then the Single Member must sign his or her name as well as print it in only the first signature area.

(18) Date Of Member’s Signature. The calendar date when the Single Member or Member #1 has signed his or her name (then printed it) must be submitted to the area on display in his or her signature area.