A New Jersey LLC operating agreement is a legal document that spells out the terms of how a limited liability company (LLC) will be owned, managed, and run. The document, while not required in order to do business, is highly recommended as it can help to prevent disputes and protect company owners from claims made in court. The document lays out such agreed-upon matters as how finances will be handled and how the company will be wound up if needed.

By Type (2)

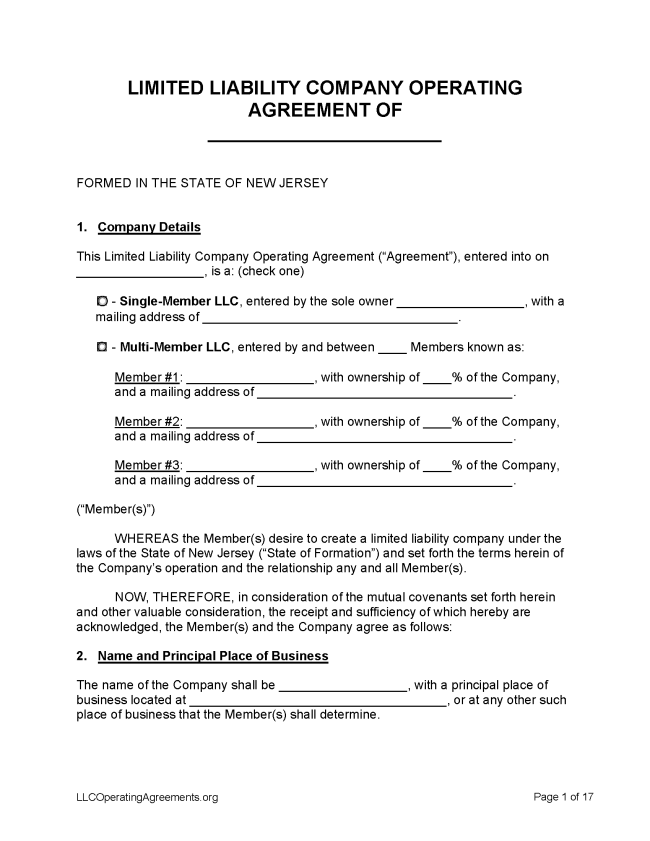

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in New Jersey

- Filing fee: $125

1. Choose a Name

The first step is to reserve a business name. The state allows an applicant to reserve a name for 120 days (§ 42:2C-10). First, check with the New Jersey Department of Treasury here whether a desired name is available for use.

2. Choose an LLC Type

Only online filing is available in the State of New Jersey.

Domestic LLC – For an LLC located within New Jersey.

- Online Filing – Select “NJ Domestic Limited Liability Company” from the dropdown menu.

Foreign LLC – For an LLC located outside New Jersey.

- Online Filing – Select “NJ Foreign Limited Liability Company” from the dropdown menu.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $50

A name can be reserved for an applicant’s exclusive use for 120 days via the delivery of an application to the Treasurer for filing (§ 42:2C-10). Reserving a name gives the applicant time to complete the LLC formation process.

- Online Filing – Select “Start the filing process” beneath “File a Business Name Reservation.”

- Paper Filing (Form UNRR-1) – Fill out an Application for Reservation of Name and send, with filing fee enclosed, to NJ Division of Revenue, PO Box 308, Trenton, NJ 08646. Checks can be made payable to Treasurer, State of New Jersey.

Renewing an LLC (Annual Report)

Filing fee: $75

Every LLC in New Jersey must file an annual report or otherwise risk being listed as inactive (§ 42:2C-26).

- Online Filing – Enter the NJ Business Entity Identification Number, business type, and formation date, then select “Continue.”

Dissolving an LLC

Filing fee: $120

In order to dissolve an LLC, a certificate of cancellation should be delivered to the filing office (§ 42:2C-49). Annual report obligations must be satisfied before the paperwork is submitted.

- Online Filing – Select “Close a Business.”

- Paper Filing (Form L-109) – Send a completed Certificate of Cancellation form, plus payment, to New Jersey Division of Revenue and Enterprise Services Business Liquidations, P.O. Box 308, Trenton, NJ 08625-0308 or hand-deliver it to New Jersey Division of Revenue and Enterprise Services, 33 West State Street, 5th floor Trenton, NJ 08608, Attn: Business Liquidations. Checks can be made payable to Treasurer, State of New Jersey.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, in a record, implied, or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in subsection a. of section 11 of this act. The term includes the agreement as amended or restated.