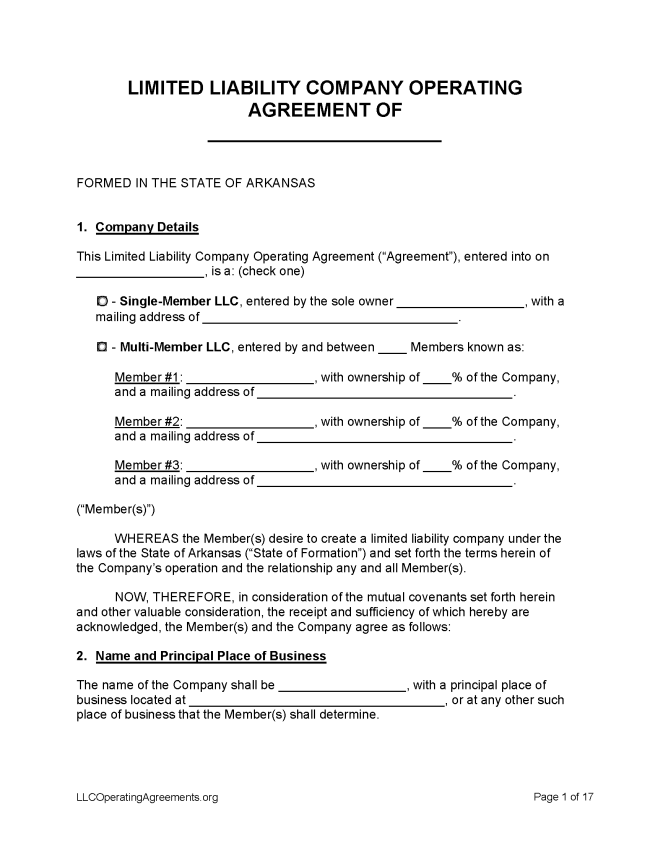

An Arkansas LLC operating agreement outlines the ownership structure and operating procedures of a limited liability company (LLC). This document clarifies how the LLC will be run and managed, how profits and losses will be handled, and how the company will be dissolved, among other matters. The operating agreement can shield the company’s owners from legal liabilities the company might incur. Each member should keep a signed copy on file.

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Arkansas

- Filing fee: $45 (domestic, online), $50 (domestic, paper), $270 (foreign, online), $300 (foreign, paper)

- Processing time: 2 business days

1. Choose a Name

Search the online database for incorporations, cooperatives, banks, and insurance companies to determine whether a preferred entity name has already been accounted for. Select either Domestic Limited Liability Company or Foreign Limited Liability Company, depending on which is being registered, from the drop-down menu. Consider perusing the Name Availability Guidelines prior to searching the database.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Arkansas.

- Online Filing – Select “Certificate of Organization for Domestic LLC – LL-01” beneath the Domestic LLC subhead. Pay the filing fee by credit card or ACH.

- Paper Filing (Form LL-01) – Fill out Form LL-01, either by typing or printing clearly in ink, and then print and sign it.

- Attach the filing fee to the form and mail or deliver it to the Business and Commercial Services Office at Victory Building, 1401 W. Capitol Avenue, Suite 250, Little Rock, AR 72201.

Foreign LLC – For an LLC located outside Arkansas.

- Online Filing – Select “App. for Certificate of Registration of For. LLC – FL-01” beneath the Foreign LLC subhead. Pay the filing fee by credit card or ACH.

- Paper Filing (Form FL-01) – Fill out Form FL-01, also known as the Application for Certificate of Registration. Print and sign it.

- Attach the filing fee to the form and mail or deliver it to the Business and Commercial Services Office at Victory Building, 1401 W. Capitol Avenue, Suite 250, Little Rock, AR 72201.

3. Post-Formation

Once the paperwork has been processed, members should sign an operating agreement and register the entity for tax purposes.

- LLC Operating Agreement – Select the operating agreement above that fits the company’s profile.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $25

A name can be reserved for a period of up to 120 days before the LLC is formed (Ark. Code § 4-38-113).

- Online Filing – Select “App. for Reservation of LLC Name – LLC-05” beneath the Domestic LLC subhead.

- Paper Filing (Form RN-06) – Mail a payment for $25 and Form RN-06 to Secretary of State’s Business and Commercial Services Division, 1401 W. Capitol, Suite 250, Little Rock, AR 72201. Make checks payable to Business and Commercial Services Division.

Renewing an LLC (Annual Report)

Filing fee: $150

An LLC in Arkansas must pay an annual franchise tax in order to continue doing business (A.C.A. § 26-54-101).

- Online Filing – Enter a file number, which is located above the company name on the tax report, and a federal tax ID if the company has one.

- Paper Filing – Fill out form and either file online at sos.arkansas.gov or send to Business and Commercial Services Division, P.O. Box 8014, Little Rock, AR 72203. Make checks payable to the Arkansas Secretary of State.

Dissolving an LLC

Filing fee: $45 (online), $50 (paper)

An LLC can be terminated through the filing of a Statement of Dissolution (Ark. Code § 4-38-702).

- Online Filing – Input filing number beneath “Articles of Dissolution for Limited Liability Company – LL-04” beneath Domestic LLC subhead, then select Start Form.

- Paper Filing (Form LL-04) – Fill out form and attach fee (checks are payable to Arkansas Secretary of State), then mail or deliver to Business and Commercial Services Division, P.O. Box 8014, Little Rock, AR 72203.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, implied, in a record, or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in § 4-38-105(a). The term includes the agreement as amended or restated.