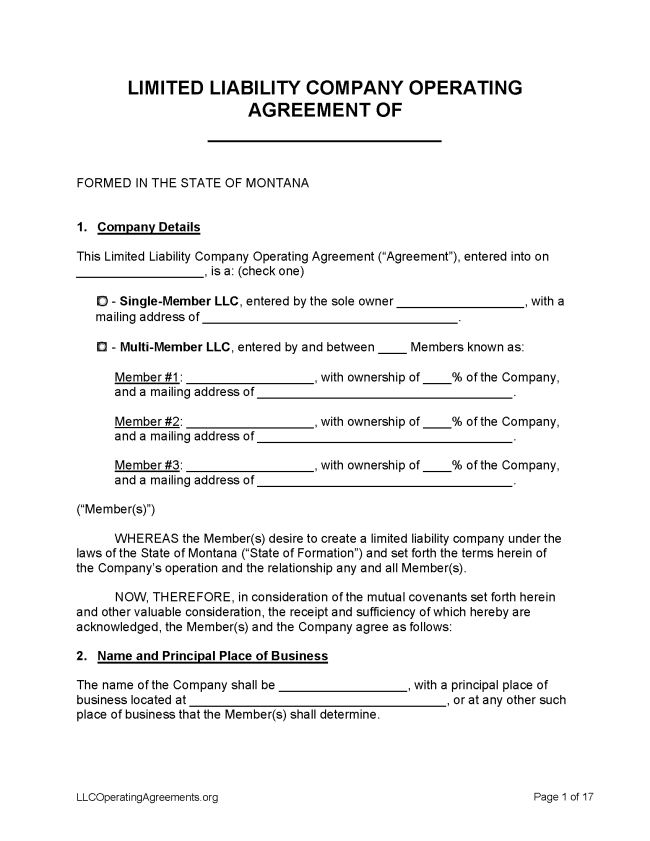

A Montana LLC operating agreement is a form that legally establishes a limited liability company (LLC) and how it will operate in Montana. The agreement, while not mandatory, is highly recommended because it can resolve disagreements among multiple owners and also because it can protect each owner’s personal assets from liabilities the company faces. A signed copy should be kept on file by each owner.

By Type (2)

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Montana

- Filing fee: $70

- Processing time: 7-10 business days

1. Choose a Name

A name can be reserved for 120 days per state statute (§ 35-8-104). First, search for a business name by clicking “Search” on this webpage in order to make sure the name isn’t already registered to another entity.

2. Choose an LLC Type

Montana only accepts online applications.

Domestic LLC – For an LLC located within Montana.

- Online Filing – Scroll down to “Articles of Organization for Domestic Limited Liability Company” beneath the “Limited Liability Companies” heading.

Foreign LLC – For an LLC located outside Montana.

- Online Filing – Scroll down to “Certificate of Authority for Foreign Limited Liability Company” beneath the “Limited Liability Companies” heading.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $10

A name can be reserved for a nonrenewable period of 120 days as an LLC is being formed (§ 35-8-104).

- Online Filing – Name reservations can be filed online; select “Reservation of Name” beneath the heading “Business Names.”

Renewing an LLC (Annual Report)

Filing fee: $20

Montana law requires that every LLC file an annual report between January 1 and April 15 of each year (§ 35-8-208). Annual reports filed after April 15 will incur additional fees.

- Online Filing – Click on the red banner, then select “File Online Annual Report Now.” Sign into ePass Montana account, then select “File My Annual Report” from the dashboard.

Dissolving an LLC

Filing fee: $15

An LLC can be terminated through the filing of articles of termination with the secretary of state (§ 35-8-906).

- Online Filing – Log in to ePass Montana account, then search for the business and click on its name. Select “Filing Actions,” and then select “Articles of Termination.”

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means an agreement, including amendments, as to the conduct of the business and affairs of a limited liability company and the relations among the members, managers, and the company that is binding upon all of the members.