A Maryland LLC operating agreement is a legal document that outlines the way a limited liability company (LLC) in the State of Maryland will be owned, managed, operated, and dissolved. The agreement determines the overall structure as well as the day-to-day activities the LLC will engage in. While the state does not require operating agreements, they are highly recommended because they can both dispel disputes and protect owners’ personal assets from claims filed against the LLC in court.

By Type (2)

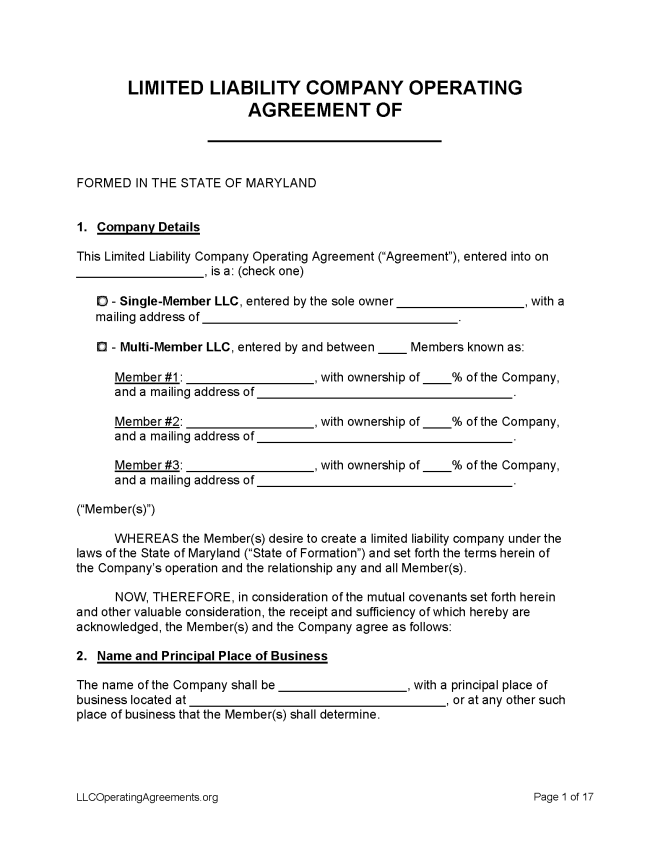

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Maryland

- Filing fee: $100

- Processing time: 6-8 weeks

1. Choose a Name

The first step is to reserve a name. Search Maryland Business Express’ Business Name Search database to determine whether a name is taken or not. When a name has been chosen, file a Corporate Name Reservation Application with the Secretary of State in order to reserve a name for 30 days (§ 4A-209).

2. Choose an LLC Type

Domestic LLC – For an LLC located within Maryland.

- Online Filing – Create an account, then select “Register.”

- Paper Filing – File a completed Articles of Organization form, plus $100 for the filing fee, to the Department of Assessments and Taxation 301 W. Preston Street Baltimore, MD 21201-2392.

Foreign LLC – For an LLC located outside Maryland.

- Online Filing – Create an account, then select “Register.”

- Paper Filing – Mail a completed Limited Liability Company Registration (For non-Maryland Limited Liability Company) form, plus $100 for the filing fee, to the Department of Assessments and Taxation 301 W. Preston Street Baltimore, MD 21201-2392.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3.

Name Reservation

- Filing fee: $25

State law allows for a name to be reserved for an applicant’s exclusive use for 30 days (§ 4A-209).

- Paper Filing – A completed Corporate Name Reservation Application, plus payment for the filing fee, should be sent to the Maryland State Department of Assessments & Taxation.

Renewing an LLC (Annual Report)

Filing fee: None

All entities in Maryland must file a Form 1 Annual Report each year before April 15 (§ 11–101).

- Online Filing – Annual reports can be filed online through the state’s Business Express platform.

- Paper Filing (Form 1) – Send a signed and completed annual report form and include a check or money order for the filing fee to Maryland Dept. of Assessments and Taxation Annual Report, P.O. Box 17052, Baltimore MD 21297-1052. See filing instructions here.

Dissolving an LLC

Filing fee: None

An LLC can be terminated through the filing of Articles of Cancellation (IC 23-0.5-9-22).

- Paper Filing – Send a completed Articles of Cancellation form to the Department of Assessments and Taxation, Charter Legal Department, 301 W. Preston Street, Room 801, Baltimore MD 21201.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means the agreement of the members and any amendments thereto, as to the affairs of a limited liability company and the conduct of its business.