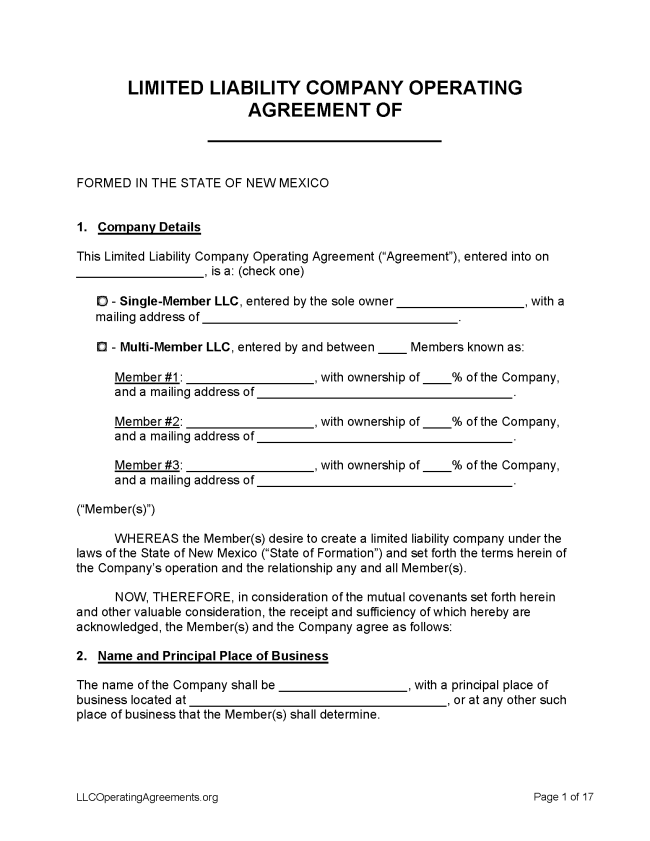

A New Mexico LLC operating agreement is a legal form that sets out the policies, procedures, and ownership of a limited liability company (LLC) in New Mexico. Businesses are not legally mandated to draft and implement an operating agreement but are highly advised to do so. The document can mitigate disputes and protect owners’ personal assets from liabilities the company may confront.

By Type (2)

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in New Mexico

- Filing fee: $100

1. Choose a Name

The first step is to choose a name that is distinguishable from other names registered with the Secretary of State. Conduct a Business Search to determine whether the entity name is available. A name can be reserved for a period of 120 days before the LLC is formally registered (§ 53-19-4).

2. Choose an LLC Type

As of April 2020, New Mexico only accepts online filings for domestic LLCs and only paper filings for foreign LLCs.

Domestic LLC – For an LLC located within New Mexico.

- Online Filing – See instructions here.

Foreign LLC – For an LLC located outside New Mexico.

- Paper Filing – Mail the completed form to the New Mexico Secretary of State Business Services Division, 325 Don Gaspar, Suite 300, Santa Fe, NM 87501.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $20

A name can be reserved for 120 days as the process of formation is underway (§ 53-19-4).

- Paper Filing – Fill out an Application for Reservation of a Domestic Limited Liability Company Name and send the completed form, along with the filing fee, to 325 Don Gaspar, Suite 300, Santa Fe, NM 87501.

Renewing an LLC (Annual Report)

Unlike other states, New Mexico does not require LLCs to file an annual report.

Dissolving an LLC

Prior to dissolving an LLC, you must

Filing fee: $25

In order for an LLC to be dissolved, articles of dissolution should be signed and submitted to the Office of the Secretary of State for filing (§ 53-19-41).

- Paper Filing – Send completed articles of dissolution form, plus payment, to New Mexico Secretary of State Business Services Division, 325 Don Gaspar, Suite 300, Santa Fe, NM 87501.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means a written agreement providing for the conduct of the business and affairs of a limited liability company and that agreement as amended in writing.