A California LLC operating agreement is a legal document that clarifies how a limited liability company (LLC) will be owned, managed, run, and dissolved. This is required by the State of California and essential in case the company encounters disputes or legal liabilities. The agreement can also protect an owner’s or multiple owners’ personal property from lawsuits.

By Type (2)

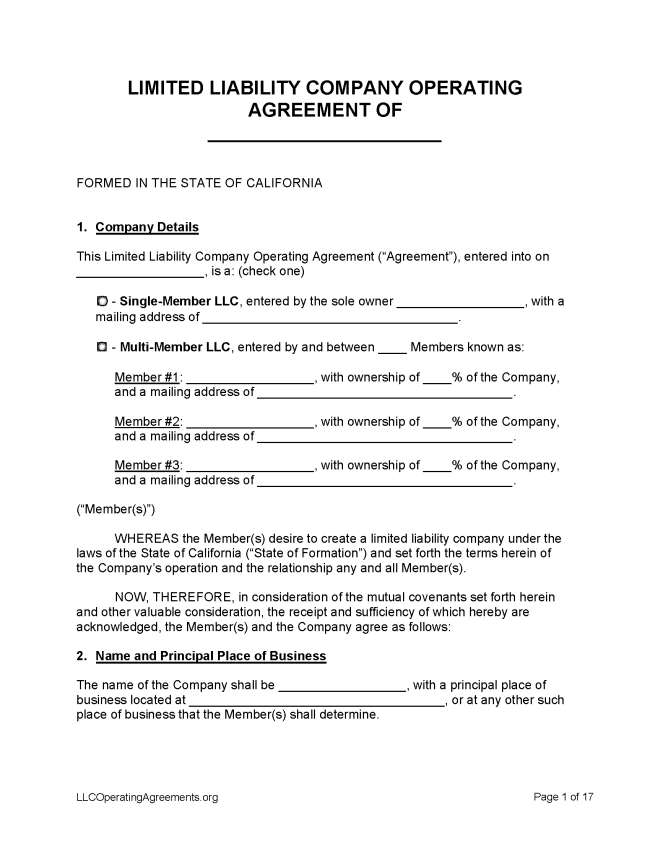

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in California

- Filing fee: $70

- Processing time: Up to 2 weeks. For 24-hour service, the fee is $350, and same-day service costs $750. Read more about processing times, which must be reported according to state law, here.

1. Choose a Name

Reserve a name for the LLC before undergoing the process of registering it. Name reservations can be submitted here. A name will not be approved if it is too similar to the name of another registered LLC. LLC names must be “distinguishable in the records” from other LLCs recorded with the California Secretary of State, per Chapter 361, Statutes of 2020 (SB 522 Hertzberg). For more information, refer to the Name Reservations page hosted by the Secretary of State.

2. Choose an LLC Type

Domestic LLC – For an LLC located within California.

- Online Filing – Create a user account here, then select Register a Business.

Foreign LLC – For an LLC located outside California.

- Online Filing – Create a user account here, then select Register a Business.

3. Post-Formation

Once the paperwork has been processed, several documents must be filed.

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $10

Upon being approved, a name is reserved for 60 calendar days (California Corporations Code § 17701.09).

- Online Filing – Create a user account, then follow the prompts.

- Paper Filing – Mail or drop off a Name Reservation Request Form and a filing fee to Secretary of State Business Programs Division, Business Entities, 1500 11st Street, 3rd Floor, Sacramento, CA 95814. An additional handling fee of $10 is added to requests delivered in person. The fee does not apply to requests lodged by mail.

Statement of Information

Filing fee: $20

Per state statute, a Statement of Information (Form LLC-12) must be filed within 90 days of registration. See this webpage to keep track of filing dates. Some states refer to the Statement of Information as an annual report and manage its filing differently. In California, though, failure to file the required Statement of Information can lead to a penalty of $250 or suspension of a registered LLC. The Statement of Information should also be filed every two years after the initial filing.

- Online Filing – Enter the company name or file number here, then click the search icon.

- Paper Filing – See Instructions for Completing the Statement of Information before filling out Form LLC-12. Mail the completed form and a check or money order to Secretary of State Business Programs Division, Business Entities, 1500 11st Street, 3rd Floor, Sacramento, CA 95814.

Dissolving an LLC

Filing fee: None

An LLC can be terminated through the filing of a Certificate of Dissolution (Cal. Corp. Code § 17707.01). Visit Guide to Dissolve, Surrender, or Cancel a California Business Entity (FTB Publication 1038) for more information.

- Online Filing – Click Termination (#7) and follow the prompts.

- Paper Filing (Form LLC-3) – Fill out the form, print, and sign it. Mail or drop off to Secretary of State Business Programs Division, Business Entities, 1500 11st Street, 3rd Floor, Sacramento, CA 95814.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, in a record, implied, or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in subdivision (a) of Section 17701.10. The term “operating agreement” may include, without more, an agreement of all members to organize a limited liability company pursuant to this title. An operating agreement of a limited liability company having only one member shall not be unenforceable by reason of there being only one person who is a party to the operating agreement. The term includes the agreement as amended or restated.