A Utah LLC operating agreement is a legal document that outlines the relationships between owners, their rights and duties, and the conduct of the business of a limited liability company (LLC) in Utah. The agreement is not required to do business in Utah; however, it is highly advisable because it can resolve disputes and protect owners from lawsuits brought against the company. Every owner should keep a signed copy on file.

By Type (2)

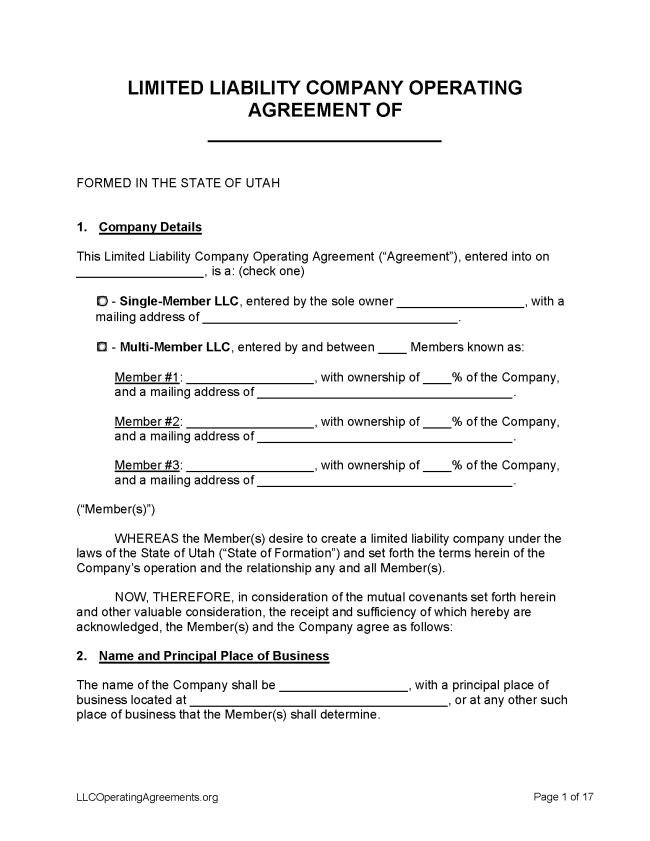

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Utah

- Filing fee: $70

- Processing time: 7 business days

1. Choose a Name

The first step is to browse the state’s database to determine whether the chosen name for the LLC is already registered to another entity. Click here to conduct a search. If available, the name can be reserved for 120 days.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Utah.

- Online Filing – Select “Continue” to create a new account if the LLC does not already have one.

- Paper Filing – Submit the completed form and the filing fee to P.O. Box 146705, Salt Lake City, UT 84114-6705. Forms must not be handwritten.

Foreign LLC – For an LLC located outside Utah.

- Online Filing – Select “Continue” to create a new account if the LLC does not already have one.

- Paper Filing – Mail a completed Foreign LLC Registration Statement along with the filing fee to P.O. Box 146705, Salt Lake City, UT 84114-6705. Forms must not be handwritten.

3. Post-Formation

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $22

A name may be reserved for an applicant’s exclusive use for 120 days (§ 48-3a-109).

- Online Filing – Select “Continue” to create a new account. Payment can be made with a credit card.

- Paper Filing – Mail a completed Application for Reservation of Business Name plus payment for the filing fee to P.O. Box 146705, Salt Lake City, UT 84114-6705.

Renewing an LLC (Annual Report)

- Filing fee: $20

State law stipulates that every LLC must submit an annual report for filing each year following the calendar year in which the LLC became formally registered (§ 48-3a-212).

- Online Filing – Renew the LLC by entering the entity number and renewal or access ID, then clicking “Login.”

Dissolving an LLC

- Filing fee: None

The LLC can be dissolved upon the filing of a Statement of Termination with the Department of Commerce’s Division of Corporations & Commercial Code (§ 48-3a-703).

- Paper Filing – Submit the completed form to P.O. Box 146705, Salt Lake City, UT 84114-6705.