A North Carolina LLC operating agreement is a legal form that outlines the ownership structure and operating procedures of a limited liability company (LLC) in North Carolina. The agreement can be written, oral, or implied, according to state law. However, a formal contract is more likely to hold up in court in the event claims are brought against the company or any of its owners. Each owner is advised to keep a signed copy on file.

By Type (2)

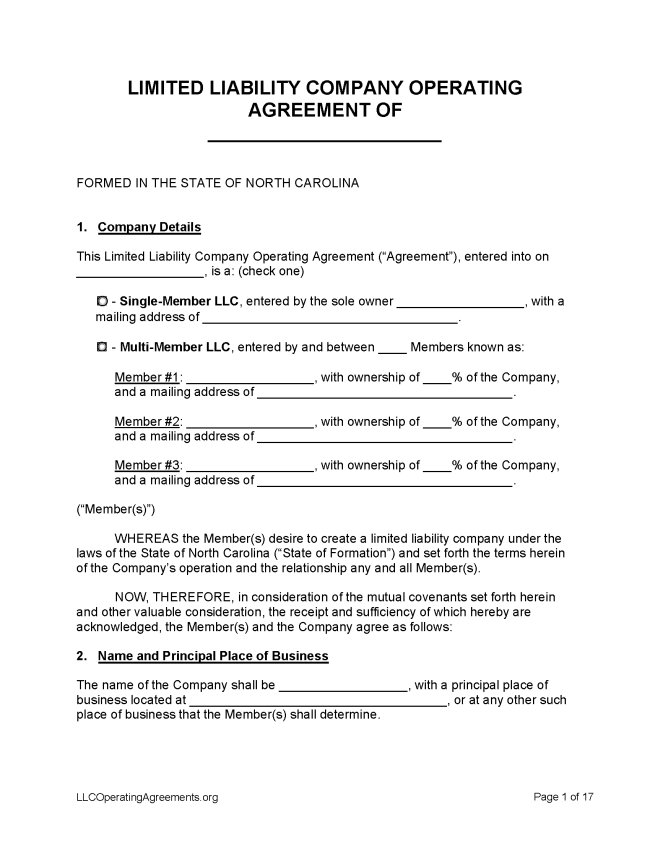

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in North Carolina

- Filing fee: $125 (domestic LLCs), $250 (foreign LLCs)

- Processing time: 5-7 business days

1. Choose a Name

An entity name can be reserved for 120 days in the State of North Carolina. Use this database to determine whether a desired name is available for use.

2. Choose an LLC Type

Domestic LLC – For an LLC located within North Carolina.

- Online Filing – Select “First time user” and create an account to file business documents online. Watch this tutorial to navigate the state’s online business portal.

- Paper Filing (Form L-01) – Select “Articles of Organization” and download the PDF, then complete the form and send it to Business Registration Division, P.O. Box 29622, Raleigh, NC 27626. Alternatively, hand-deliver it to 2 South Salisbury Street, Raleigh, NC 27601, located directly across from the State Capitol Building. Enclose payment for the filing fee; make checks payable to NC Secretary of State.

Foreign LLC – For an LLC located outside North Carolina.

- Online Filing – Select “First time user” and create an account to file business documents online. Watch this tutorial to navigate the state’s online business portal.

- Paper Filing (Form L-09) – Select “Application of Certificate of Authority” and download the PDF, then complete the form and send it to Business Registration Division, P.O. Box 29622, Raleigh, NC 27626. Alternatively, hand-deliver it to 2 South Salisbury Street, Raleigh, NC 27601, located directly across from the State Capitol Building. Enclose payment for the filing fee; make checks payable to NC Secretary of State. Click here for a guide to registering a foreign business.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $10

A name can be reserved for 120 days while LLC paperwork is being filed and processed (§ 55D-23(c)).

- Paper Filing (Form BE-03) – Select “Application to Reserve a Business Entity Name” and download the PDF. Complete an Application to Reserve a Business Entity Name and submit to the Secretary of State, either by mail or hand-delivery.

Renewing an LLC (Annual Report)

Filing fee: $200

Every LLC in North Carolina must deliver an annual report. The first report is due by April 15 of the year following the year in which the LLC was formed (§ 57D-2-24).

- Online Filing – Select “File a Business Annual Report HERE!” Search for business entity name and in the last column entitled “Actions/Type” click on the monitor icon. Click “File Most Recent Annual Report.”

- Paper Filing – Follow the instructions for downloading a paper form and submitting to the Secretary of State here.

Dissolving an LLC

Filing fee: $30

An LLC is dissolved through the filing of articles of dissolution with the Secretary of State (§ 57D-6-09).

- Online Filing – Sign in and follow the prompts to dissolve the LLC. Payment for the filing fee can be made with a credit card.

- Paper Filing (Form L-07) – Scroll down to “Articles of Dissolution” and click the link to download the PDF. Send to Business Registration Division, P.O. Box 29622, Raleigh, NC 27626.

Statutes

“LLC Operating Agreement” Definition

Any agreement concerning the LLC or any ownership interest in the LLC to which each interest owner is a party or is otherwise bound as an interest owner. Subject to other controlling law, the operating agreement may be in any form, including written, oral, or implied, or any combination thereof. The operating agreement may specify the form that the operating agreement must take, in which case any purported amendment to the operating agreement or other agreement expressed in a nonconforming manner will not be deemed to be part of the operating agreement and will not be enforceable to the extent it would be part of the operating agreement if it were in proper form. Subject to G.S. 57D-2-21 and the other provisions of this Chapter governing articles of organization, the articles of organization are to be deemed to be, or be part of, the operating agreement. If the LLC has only one interest owner and no operating agreement to which another person is a party, then any document or record intended by the interest owner to serve as the operating agreement will be the operating agreement.