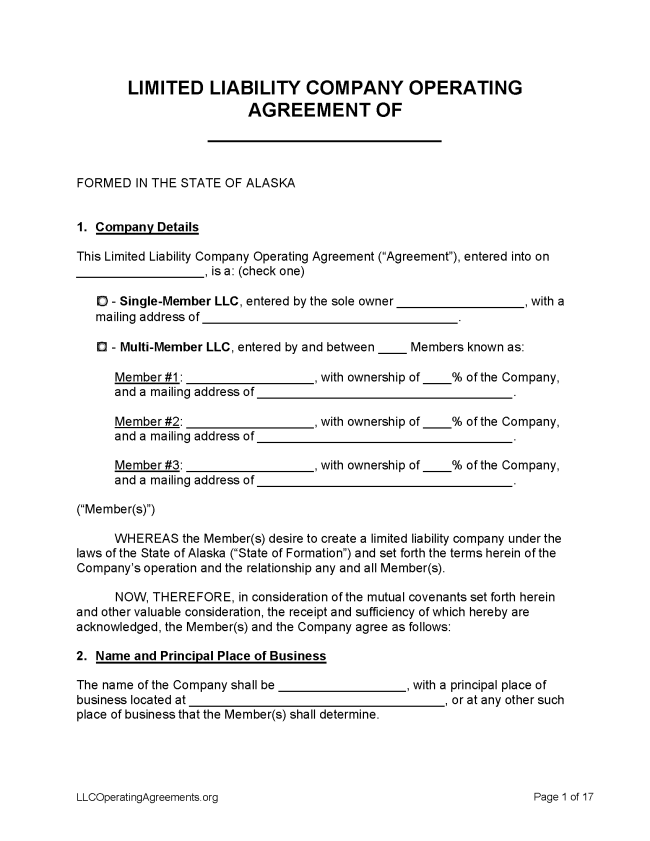

An Alaska LLC operating agreement allows a company to set rules for the entity such as its management, registered agent, and record its owners. In an LLC, ownership is listed as a percentage (%) that requires all owners (members) should be mentioned in full (totaling 100%).

In Alaska, it is written that the “articles of organization may restrict or eliminate the power of the members,” therefore all members in the operating agreement should be listed in the articles.

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Alaska

- Filing fee: $250 (domestic), $350 (foreign)

- Processing time: 10-15 business days from March to September, and greater than 15 business days from October to February.

1. Choose a Name

Use the Dept. of Commerce, Community, and Economic Development’s corporations database to perform a search and verify if the name is in use. If there is a matching entity, choose another name and perform the search until there are no similar results.

2. Select an LLC Type

Domestic LLC – For an LLC located within Alaska.

- Online Filing – Scroll to the bottom of the page and click the button titled ‘Proceed to Online Filing’.

- Paper Filing (Form 08-484) – Also known as the “Articles of Organization.”

- Attach a check for $250 payable to the “Division of Corporations, Business and Professional Licensing” and send to: State of Alaska, Corporations Section, PO Box 110806, Juneau, AK 99811-0806.

Foreign LLC – For an LLC located outside Alaska.

- Online Filing – Scroll to the bottom of the page and click the button titled ‘Proceed to Online Filing’.

- Paper Filing (Form 08-497) – Also known as the “Certificate of Registration.”

- Attach a check for $350 payable to the “Division of Corporations, Business and Professional Licensing” and send to: State of Alaska, Corporations Section, PO Box 110806, Juneau, AK 99811-0806.

3. File the Initial Report

An initial report must be filed within 6 months after creating an LLC to avoid non-compliance.

- File Initial Report Online – Free

4. Post-Formation

After the LLC is processed, the owners should take the necessary steps to establish the ownership of the company and register with the IRS. This can be done by completing the following:

- LLC Operating Agreement – Finalizes the ownership of the company along with making rules for the company.

- Federal Employer Identification Number (FEIN) – Click the ‘Apply Online Now‘ button and obtain a tax ID number. This will be generated in a PDF known as Form SS-4.

Name Reservation

- Filing fee: $25

An LLC name can be reserved for a period of up to 120 days prior to forming with the State (AS 10.50.035).

- Online Filing – Scroll to the bottom of the page and click ‘Proceed to Online Filing’ button.

- Paper Filing (Form 08-561) – Attach a check for $25 payable to the “Division of Corporations, Business and Professional Licensing” and send to: PO Box 110806, Juneau, AK 99811-0806

Renewing an LLC (Biennial Report)

Filing fee: $100

An LLC must be renewed once each 2-year period (AS 10.50.760).

- Online Filing – Click the button ‘Proceed to Initial Report Online Filing’.

Dissolving an LLC

Filing fee: $25

The members of a company can terminate an LLC’s existence by filing a voluntary dissolution with the State (AS 10.50.430).

- Paper Filing (Form 08-490) – Also known as an “Articles of Dissolution,” attach a check for $25 payable to “Division of Corporations, Business and Professional Licensing” (or use the attached credit card payment form) and be sent to: PO Box 110806, Juneau, AK 99811-0806.

Statutes

“LLC Operating Agreement” Definition

“operating agreement” means a written agreement among all of the members of a limited liability company about conducting the affairs of the company.