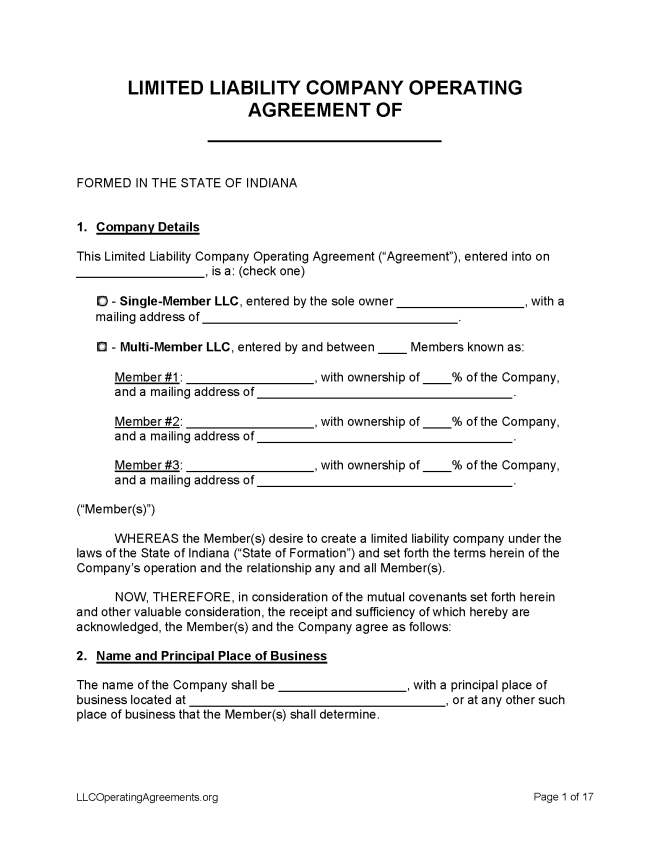

An Indiana LLC operating agreement is a legal document that outlines how a limited liability company (LLC) in Indiana will be owned, managed, run, and dissolved. The form can lessen the likelihood of dispute among owners and can also protect owners’ personal property from any liabilities incurred by the company. Every member is advised to keep a signed copy on file.

By Type (2)

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Indiana

- Filing fee: $100

- Processing time: Up to 5 weeks

1. Choose a Name

The first step is to file an application to reserve a name. The name must be distinguishable, per state statute, from other names already registered with the Secretary of State. To check if a name is available, call 317-232-6576 or search this database. If the name is not accounted for, file an application to reserve the name.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Indiana.

- Online Filing – Create an account, then follow the prompts.

- Paper Filing (Form 49459) – A completed Articles of Organization form, as well as a payment for the filing fee, should be mailed or delivered to 302 West Washington Street, Room E-018, Indianapolis IN 46204.

Foreign LLC – For an LLC located outside Indiana.

- Online Filing – Make a user account, then follow the prompts.

- Paper Filing (Form 56369) – Mail Form 56369, plus a payment for the filing fee, to 302 West Washington Street, Room E-018, Indianapolis IN 46204.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $20

State law allows for a name not already registered to be reserved for 120 days while the LLC formation process is underway (IC 23-0.5-3-3).

- Online Filing – Name reservations can be filed online.

Renewing an LLC (Annual Report)

Filing fee: $30

Indiana law requires LLCs to file business entity reports biennially (IC 23-0.5-2-13).

- Online Filing – Create an account or log on to INBiz to see upcoming due date.

Dissolving an LLC

Filing fee: $20 for online filing, $30 for paper filing

An LLC can be terminated through the filing of Articles of Termination (IC 23-0.5-9-22).

- Online Filing – Select “File Dissolution” in the “Indiana Business” tab.

- Paper Filing – Send the Articles of Dissolution form and payment for the filing fee to 302 West Washington Street, Room Checks can be made payable to the Secretary of State.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means any written or oral agreement of the members as to the affairs of a limited liability company and the conduct of its business that is binding upon all the members.