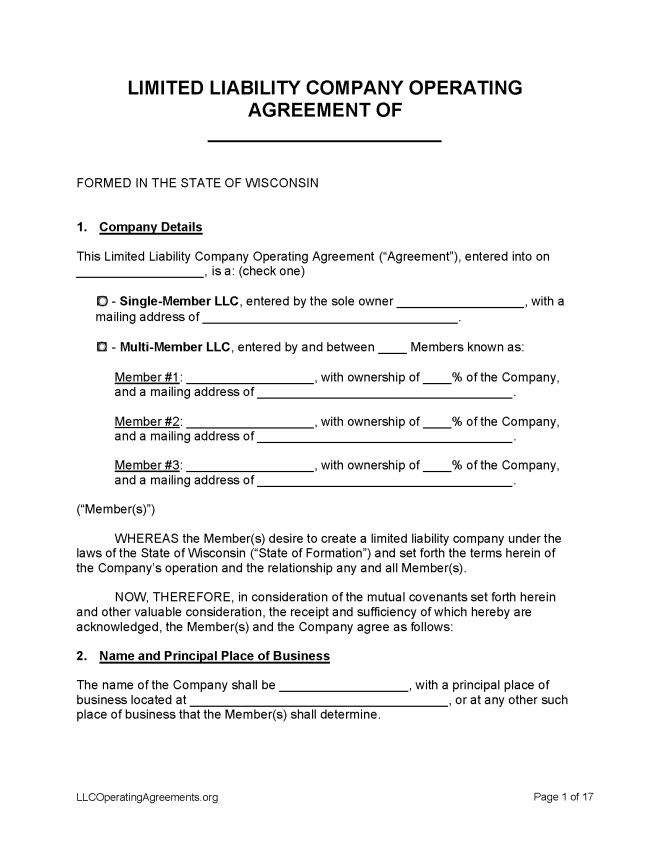

A Wisconsin LLC operating agreement is a legal document that establishes the way a limited liability company (LLC) in Wisconsin will operate. The document refers to the ownership structure, policies, and procedures the LLC will implement. Every member should keep a copy on file.

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Wisconsin

- Filing fee: $130 (online filings), $170 (paper filings)

- Processing time: 5 business days

1. Choose a Name

The first step in the process of registering an LLC in Wisconsin is to search the corporate records to determine whether a chosen name is available for use.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Wisconsin.

- Online Filing – Online portal.

- Paper Filing (Form 502) – Complete the Articles of Organization form and send along with filing fee to State of WI-Dept. of Financial Institutions, Division of Corporate and Consumer Services, 4822 Madison Yards Way, North Tower, Madison, WI 53705.

Foreign LLC – For an LLC located outside Wisconsin.

- Online Filing – Online portal.

- Paper Filing (Form 521) – Complete the form and send with filing fee to State of WI – Dept. of Financial Institutions, P.O. Box 93348, Milwaukee, WI 53293. Make checks payable to the Department of Financial Institutions.

3. Post-Formation

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $10

The State of Wisconsin allows a person to reserve a name for an LLC for up to 120 days (§ 181.0402).

- Paper Filing (Form 1) – Complete the Name Reservation Application and send it to State of WI-Dept. of Financial Institutions, Box 93348, Milwaukee, WI 53293-0348, together with a check for the filing fee, payable to the department.

Renewing an LLC (Annual Report)

- Filing fee: $25 (domestic LLCs), $80 (foreign LLCs)

In Wisconsin, LLCs are required to deliver an annual report each year following the calendar year in which the company is established (§ 180.1622).

- Online Filing – Log in using the LLC’s name or entity ID to file an annual report online.

- Paper Filings (Form 5-I) – Send completed annual report and filing fee to State of WI-Dept. of Financial Institutions, P.O. Box 93348, Milwaukee, WI 53293.

Dissolving an LLC

Filing fee: $20

An LLC can be dissolved with the filing of Articles of Dissolution with the Department of Financial Institutions (§ 180.1403).

- Online Form (Form 510) —This form dissolves or terminates an LLC; there is a $20.00 filing fee and any additional fee.

Statutes

“LLC Operating Agreement” Definition