An Arizona LLC operating agreement is a document that details the company’s ownership, roles, and management. Each active member of the LLC should hold a copy of the agreement. If anything should change in the company, the operating agreement should be amended to reflect the changes made. It is not registered with the Secretary of State, so it is recommended to keep it in a safe and accessible place.

By Type (2)

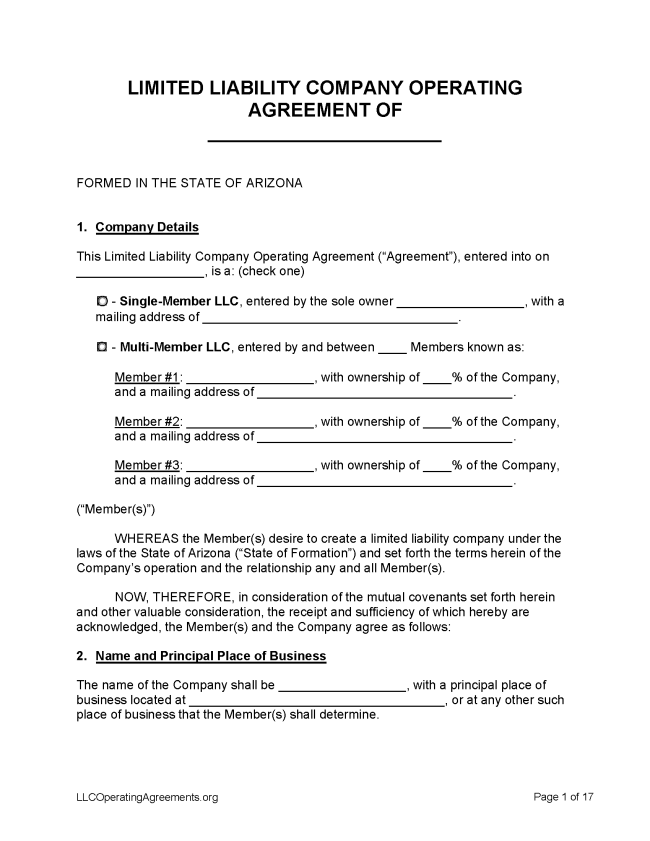

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Arizona

- Filing Fee: $50 (expedited fees range from $35 to $400)

- Processing time: 2 hours to 14 days (depends if expedited)

1. Choose a Name

Select a name and enter it into the Arizona Corporation Commission database to find out if it’s already been taken. Perform the search by entering in the “Entity Name” field and, if there are no results, the name is available for use.

2. Choose Entity Type

- Domestic LLC – If the business is located within Arizona. If the business is performing professional service, make sure to select accordingly.

- Create Online – Scroll to the bottom of the page and login or register.

- Paper Filing – Download and complete Form L010.007 and the Cover Sheet. Attach a check for $50 made payable to the “Arizona Corporation Commission.”

- Mail: Arizona Corporation Commission – Examination Section 1300 W. Washington St., Phoenix, Arizona 85007

- Fax: 602-542-4100 (for regular or expedited service)

- Fax: 602-542-0900 (for next day or same day service)

- Foreign LLC – For a company located outside of Arizona and seeking to do business within the State.

- Paper Filing – Download and complete Form L025.005 and the Cover Sheet. Attach a check for $150 made payable to the “Arizona Corporation Commission.”

- Mail: Arizona Corporation Commission – Examination Section 1300 W. Washington St., Phoenix, Arizona 85007

- Fax: 602-542-4100 (for regular or expedited service)

- Fax: 602-542-0900 (for next day or same day service)

- Paper Filing – Download and complete Form L025.005 and the Cover Sheet. Attach a check for $150 made payable to the “Arizona Corporation Commission.”

3. Expedited Fees (optional)

According to the Schedule of Fees, a filer may be able to speed up the process by adding the following fee to the original filing fee amount:

- Expedited. $35 (automatically charged when creating online)

- Next day service. $100

- Same day service. $200

- 2-hour service. $400

4. Post-Formation

After an LLC is created, the owners (members) of the company will need to do a couple of things in order to conduct business within the State.

- LLC Operating Agreement – Official company record that allows a company to outline its ownership and entity rules of conduct.

- Federal Employer Identification Number (FEIN) – A tax ID number lets a company open bank accounts and hire employees.

Name Reservation

- Filing Fee: $10 (online $35)

An LLC name may be reserved for a period of 120 days prior to the formation (ARS § 29-3113).

Domestic LLC Name Reservation

- Reserve Online – Scroll to the bottom of the page and login or register.

- Paper Filing – Download and complete Form L001.005 and the Cover Sheet. Attach a check for $10 made payable to the “Arizona Corporation Commission.”

- Mail: Arizona Corporation Commission – Examination Section 1300 W. Washington St., Phoenix, Arizona 85007

- Fax: 602-542-4100

Foreign LLC Name Reservation

- Paper Filing – Download and complete Form C007.004 and the Cover Sheet. Attach a check for $10 made payable to the “Arizona Corporation Commission.”

- Mail: Arizona Corporation Commission – Examination Section 1300 W. Washington St., Phoenix, Arizona 85007

- Fax: 602-542-4100

Renewing an LLC

There are no renewal or annual reports for LLCs to be filed in Arizona unless other license-related annual fees are connected with the company.

Corporations must file an annual report and pay a $45 fee. This can be renewed online at the Arizona Corporations Commission website.

Dissolving an LLC

Filing Fee: $35

Form L031.005 and the Cover Sheet must be downloaded and completed to terminate an LLC (ARS § 29-3701). Once complete, attach the check, made payable to the “Arizona Corporations Commission,” and send the 3 items to:

- Mail: Arizona Corporation Commission – Examination Section 1300 W. Washington St., Phoenix, Arizona 85007

- Fax (for Regular or Expedite Service ONLY): 602-542-4100

- Fax (for Same Day/Next Day Service ONLY): 602-542-0900

Statutes

- ARS § 29-3105 – Operating agreement; scope, function and limitations

- ARS § 29-3106 – Operating agreement; effect on limited liability company and persons becoming members; preformation agreement

- ARS § 29-3107 – Operating agreement; amendment; effect on third parties and relationship to records effective on behalf of limited liability company

“LLC Operating Agreement” Definition

“Operating agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, implied, in a record or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in section 29-3105, subsection A. Operating agreement includes the agreement as amended or restated.