A Nebraska LLC operating agreement is a legal document that outlines the duties, responsibilities, and rights of the owners of a limited liability company (LLC) in Nebraska. Businesses are not required by state law to have an operating agreement on file; however, having one can prevent disputes and protect owners’ personal property from claims made against the LLC.

By Type (2)

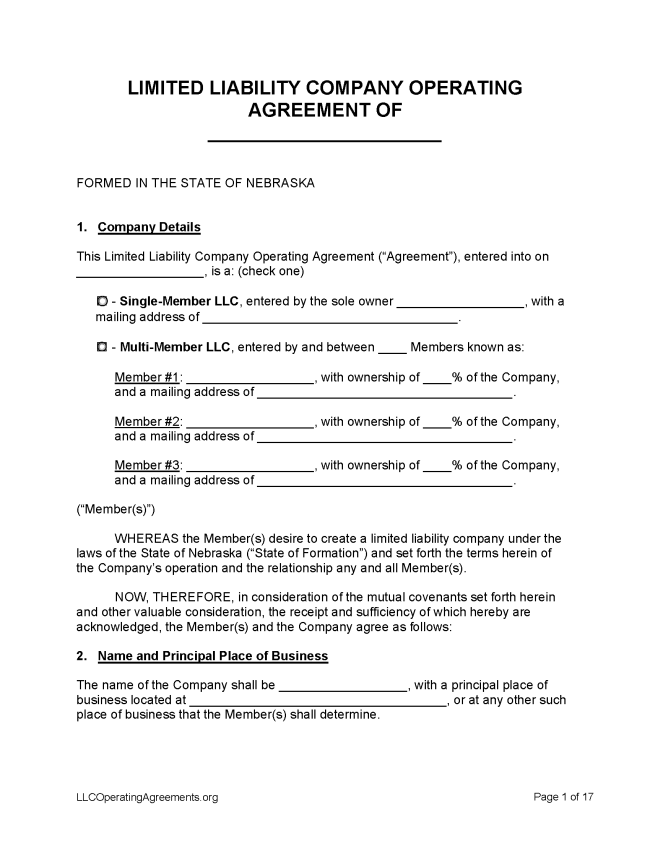

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Nebraska

- Filing fee: $110 (in office), $100 (online)

- Processing time: 4 days (if filed online), 4 weeks (if filed by mail)

1. Choose a Name

A name can be reserved for an applicant’s exclusive use for 120 days, provided the name is available and not already registered to another entity (§ 21-109). To inquire about whether a name is available, a request can be made via mail, fax, or email.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Nebraska.

- Online Filing – Select “forming a new entity/qualifying a foreign entity” beneath the heading “Select Filing Type,” then select “Continue.”

Foreign LLC – For an LLC located outside Nebraska.

- Online Filing – Select “forming a new entity/qualifying a foreign entity” beneath the heading “Select Filing Type,” then select “Continue.”

- Paper Filing – Mail a completed Application for Certificate of Authority and payment to the Secretary of State’s Office, Business Services Division, P.O. Box 94608, Lincoln NE 68509. Include a cover letter with contact information.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the corporation’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $30

State statute decrees that a name can be reserved for an applicant’s exclusive use for 120 days before the LLC is formed (§ 21-109). Inquiries about the name availability of corporate entity names must be submitted in writing, either via fax to (402) 471-3666 or by email to sos.corp@nebraska.gov or by mailing an application to the Secretary of State’s Office, Business Services Division, P.O. Box 94608, Lincoln NE 68509. Online reservations are not available.

- Paper Filing – An Application for Reservation of Limited Liability Company Name should be mailed, along with the filing fee, to Secretary of State P.O. Box 94608, Lincoln NE 68509.

Renewing an LLC (Biennial Report)

Filing fee: $10

An LLC operating in Nebraska must file biennial reports in odd-numbered years. Reports are due by April 1 of each odd-numbered year, per state statute (§ 21-125).

- Online Filing – Select “filing for an existing entity/trade name” beneath “Select Filing Type” heading.

Dissolving an LLC

Filing fee: $25 (online), $30 (in office)

An LLC is dissolved when a Statement of Dissolution is filed with the Secretary of State (§ 21-148).

- Paper Filing – A completed Statement of Dissolution, together with payment for the filing fee, should be sent to the Secretary of State’s Office, Business Services Division, P.O. Box 94608, Lincoln NE 68509.

Statutes

“LLC Operating Agreement” Definition

Operating agreement means the agreement, whether or not referred to as an operating agreement and whether oral, in a record, implied, or in any combination thereof, of all the members of a limited liability company, including a sole member. The term includes the agreement as amended or restated.