A Florida LLC operating agreement clarifies the ownership structure and operating procedures of a limited liability company (LLC) formed in Florida. The agreement can pertain to an LLC created either domestically or from out of state, and while it is not required by state law, it can go a long way in preventing and resolving disputes and legal matters. An operating agreement can also shield members’ personal property from claims made against the company in court.

By Type (2)

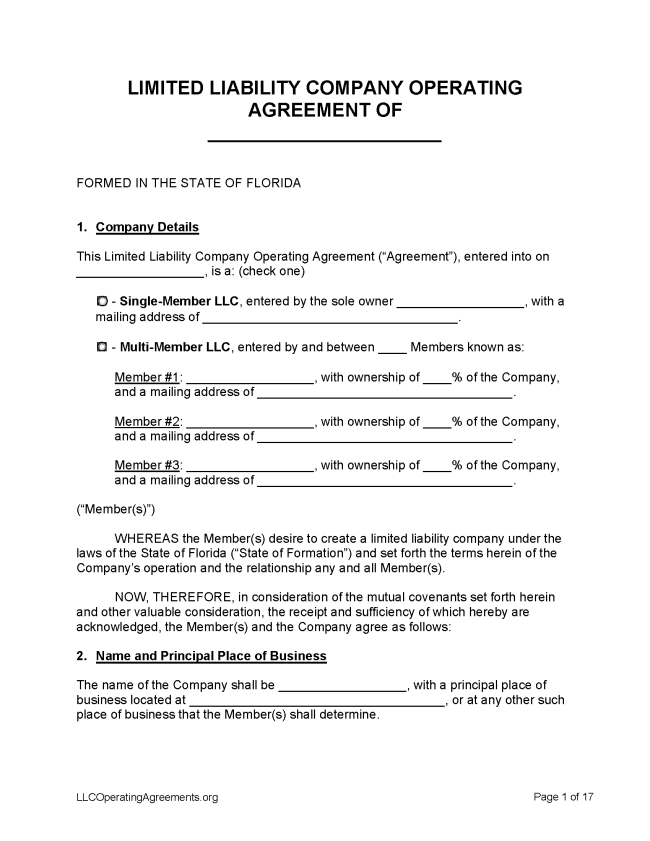

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Florida

- Filing fee: $125

- Processing time: 1 month for filings by mail, 2 weeks for online filings

1. Choose a Name

Search the Florida Department of State Division of Corporations records here. Be mindful that state statute requires names to be distinguishable from other LLC names, and the applicant is responsible for any infringement, so it is important to be careful in the name search process. The Sunbiz database is updated daily. A name can be reserved for a period of 120 days through the submission of a letter to the Secretary of State that specifies the name to be reserved, as well as the name and address of the applicant.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Florida.

- Online Filing – Articles of Organization can be e-filed using this platform. See instructions for filing here.

- Paper Filing (Form CR2E047) – The cover letter and completed form, as well as a payment for the filing fee, should be mailed to New Filing Section, Division of Corporations, P.O. Box 6327 Tallahassee, FL 32314 or delivered to New Filing Section, Division of Corporations, The Centre of Tallahassee 2415 N. Monroe Street, Suite 810 Tallahassee, FL 32303.

Foreign LLC – For an LLC located outside Florida.

- Online Filing – Not available for foreign LLCs.

- Paper Filing (Form CR2E027) – The cover letter and completed form, as well as a payment for the filing fee, should be mailed to Registration Section, Division of Corporations, P.O. Box 6327 Tallahassee, FL 32314 or delivered to Registration Section, Division of Corporations, The Centre of Tallahassee 2415 N. Monroe Street, Suite 810 Tallahassee, FL 32303.

3. Post-Formation

Once the paperwork has been processed, members should sign an operating agreement and register the entity for tax purposes.

- LLC Operating Agreement – Select the operating agreement above that fits the company’s profile.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $25

A name can be reserved for a period of up to 120 days before the LLC is formed (§ 605.01125, 607.04021, 620.11085).

- A name can be reserved through the submission of a letter to the Secretary of State that specifies the name to be reserved, as well as the name and address of the applicant.

Renewing an LLC (Annual Report)

Filing fee: $150

An LLC in Florida must file an annual report before May 1 of each year in order to avoid a $400 penalty and continue doing business (§ 605.0212).

- Online Filing – Prepare for filing by gathering document number and a valid form of payment (e.g. credit card or debit card). Select “Click Here to File Your Annual Report” button. See instructions for filing annual reports here.

- Paper Filing – Include a check or money order for payment of the filing fee. Make checks payable to Florida Department of State.

Dissolving an LLC

Filing fee: $25

An LLC can be terminated through the filing of Articles of Dissolution with the Department of Corporations (§ 605.0707).

- Online Filing – Select “File Articles of Dissolution for a Limited Liability Company.” Review the filing instructions here.

- Paper Filing (Form CR2E048) – A cover letter, completed Certificate of Dissolution, and payment for $25 should be mailed to Registration Section, Division of Corporations, P.O. Box 6327 Tallahassee, FL 32314 or delivered to Registration Section, Division of Corporations, The Centre of Tallahassee 2415 N. Monroe Street, Suite 810 Tallahassee, FL 32303. Checks can be made payable to Florida Department of State.

Statutes

“LLC Operating Agreement” Definition