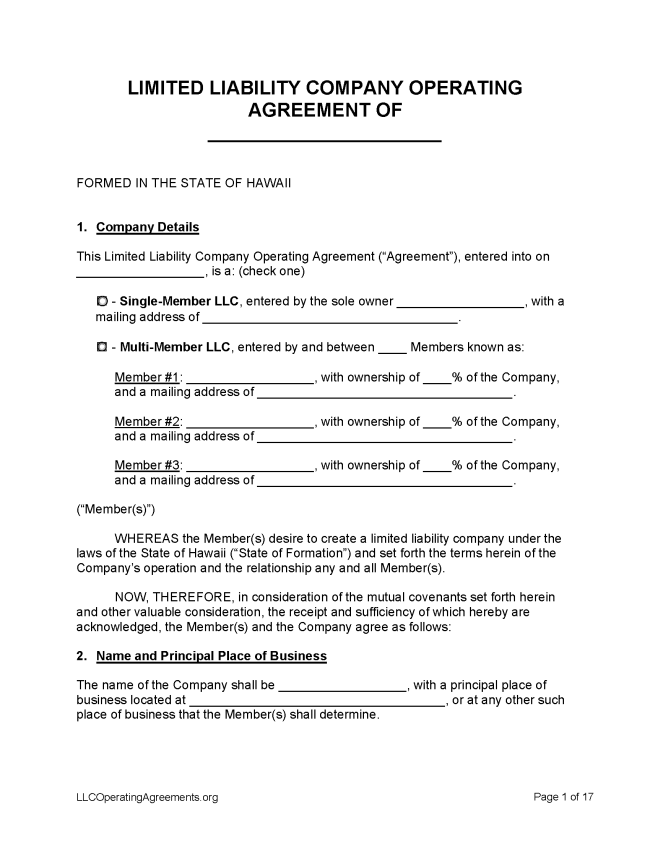

A Hawaii LLC operating agreement is a document that clarifies the way a limited liability company (LLC) in Hawaii will be owned, managed, run, and dissolved. The operating agreement can ensure multiple owners/members are on the same page about how the company will conduct its business. Another advantage of an operating agreement is its ability to protect owners’ personal assets from claims made against the company in court.

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Hawaii

- Filing fee: $50

- Processing time: 3-5 business days

1. Choose a Name

The first step is to submit an Application for Reservation of Name, so as to reserve the company’s name for 120 days while the formation process is underway. A name for a domestic LLC should contain the phrase Limited Liability Company or the abbreviation L.L.C. or LLC. Name reservations can be filed online or via Form X-1.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Hawaii.

- Online Filing – Select “Get started” under the “Start” subhead and follow the instructions. Payments can be made by credit card.

- Paper Filing (Form LLC-1) – Paper filings should be typewritten or printed in black ink and can be accepted at the service window and via email, mail, and fax. The mailing address is P.O. Box 40, Honolulu HI 96810, and the delivery address is 335 Merchant Street, Room 201, Honolulu HI 96813. Checks can be made payable to the Department of Commerce and Consumer Affairs. To email documents, use the address breg-doci-filing@dcca.hawaii.gov. To fax, use the number (808) 586-2733.

Foreign LLC – For an LLC located outside Hawaii.

- Online Filing – Select “Get started” under the “Start” subhead and follow the instructions. Payments can be made by credit card.

- Paper Filing (Form FLLC-1) – Paper filings should be typewritten or printed in black ink and can be accepted at the service window and via email, mail, and fax. The mailing address is P.O. Box 40, Honolulu HI 96810, and the delivery address is 335 Merchant Street, Room 201, Honolulu HI 96813. Checks can be made payable to the Department of Commerce and Consumer Affairs. To email documents, use the address breg-doci-filing@dcca.hawaii.gov. To fax, use the number (808) 586-2733.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $10

State statute provides that an Application for Reservation of Name, if approved, can reserve a name for the applicant’s exclusive use for up to 120 days (§ 428-106).

- Online Filing – Name reservations can be filed online through Hawaii Business Express.

- Paper Filing (Form X-1) – An Application for Reservation of Name should be typed or printed in black ink, and mailed with a $10 payment to P.O. Box 40, Honolulu HI 96810. Checks can be made payable to the Department of Commerce and Consumer Affairs.

Renewing an LLC (Annual Report)

Filing fee: $15

Hawaii state law provides that an annual report should be filed each year (§ 428-210). The date of registration will determine the filing date for each annual report; see these instructions to determine the applicable due date.

- Online Filing – Enter the company’s file number to begin the process of renewing the LLC.

- Paper Filing (Form C5) – Mail the completed form with fee to Annual Filing BREG, P.O. Box 40, Honolulu HI 96810.

Dissolving an LLC

Filing fee: $25

An LLC can be terminated through the filing of Articles of Termination (§ 428-805).

- Online Filing – Enter the LLC name in the business name field, open the record, navigate to the “Forms” tab and select “LLC-11 Articles of Termination.”

- Paper Filing (Form LLC-11) – Complete the Articles of Termination form in black ink, then send the completed form plus the filing fee to Business Registration Division, P.O. Box 40, Honolulu HI 96810.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means the agreement under section 428-103 concerning the relations among the members, managers, and limited liability company. The term includes amendments to the agreement.