A Mississippi LLC operating agreement is a document that outlines how a limited liability company (LLC) will be structured, managed, operated, and even dissolved. The agreement, while not required in order to practice business in the State of Mississippi, can bind owners or members to a specific set of guidelines, expectations, duties, responsibilities, and principles. The agreement can prevent and resolve disputes and it is highly advisable for every owner of an LLC to retain a copy on file.

By Type (2)

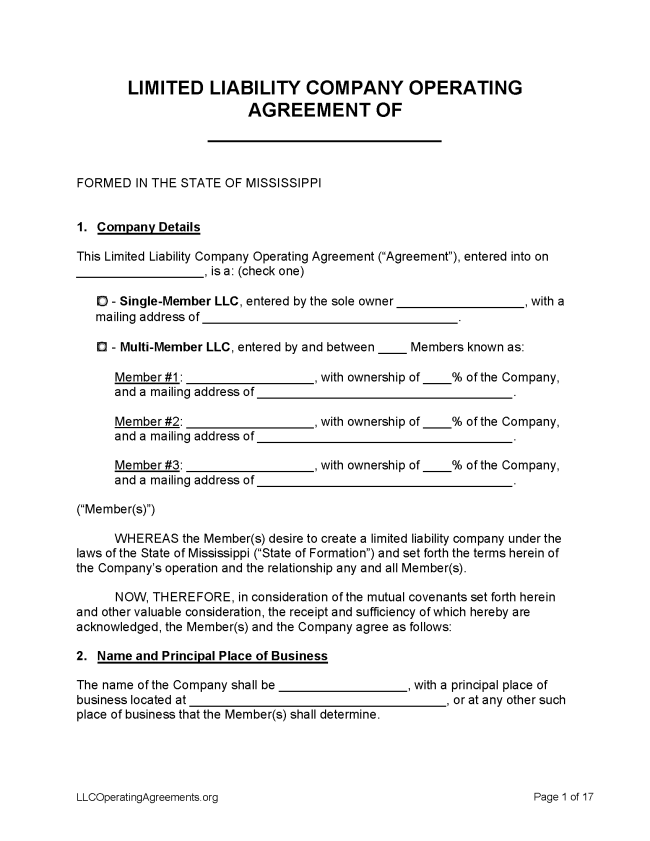

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Mississippi

- Filing fee: $50 for domestic LLCs, $250 for foreign LLCs

- Processing time: 1-2 days

1. Choose a Name

The first step in the process of forming an LLC is to reserve a name. Search the state’s online database to determine whether the name under consideration is already registered to another entity. If the Secretary of State’s office approves an application to reserve a name, the name can be reserved for the applicant’s exclusive use for 180 days.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Mississippi.

- Online Filing – Create an account, then follow the prompts. The State of Mississippi only accepts applications lodged online, not by mail.

Foreign LLC – For an LLC located outside Mississippi.

- Online Filing – Create an account, then follow the prompts. The State of Mississippi only accepts applications lodged online, not by mail.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3.

Name Reservation

- Filing fee: $25

A name can be reserved for an applicant’s exclusive use for 180 days (§ 79-29-111).

- Online Filing – Complete the online Name Reservations Filing, then select “Next.”

Renewing an LLC (Annual Renewal)

Filing fee: None for domestic LLCs, $250 for foreign LLCs

Every LLC must either deliver an annual report to the Secretary of State or risk being dissolved (§ 79-29-215). Annual reports are due by April 15 each year.

- Online Filing – Annual reports can only be filed online. Sign into the online filing portal and select “File an Annual Report.”

Dissolving an LLC

Filing fee: $50 for domestic LLCs, $25 for foreign LLCs

An LLC can be dissolved with the filing of a certificate of dissolution (§ 79-29-205).

- Online Filing – Fill out the online form to dissolve an LLC and select “Next” when form is complete.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” or “limited liability company agreement” means any agreement, whether referred to as a limited liability company agreement or otherwise, written, oral or implied, of the member or members as to the affairs of a limited liability company and the conduct of its business. A member or manager of a limited liability company or an assignee of a financial interest is bound by the operating agreement whether or not the member or manager or assignee executes the operating agreement. A limited liability company is not required to execute its operating agreement. A limited liability company is bound by its operating agreement whether or not the limited liability company executes the operating agreement. An operating agreement of a limited liability company having only one (1) member shall not be unenforceable by reason of there being only one (1) person who is a party to the operating agreement. An operating agreement may provide rights to any person, including a person who is not a party to the operating agreement, to the extent set forth therein.