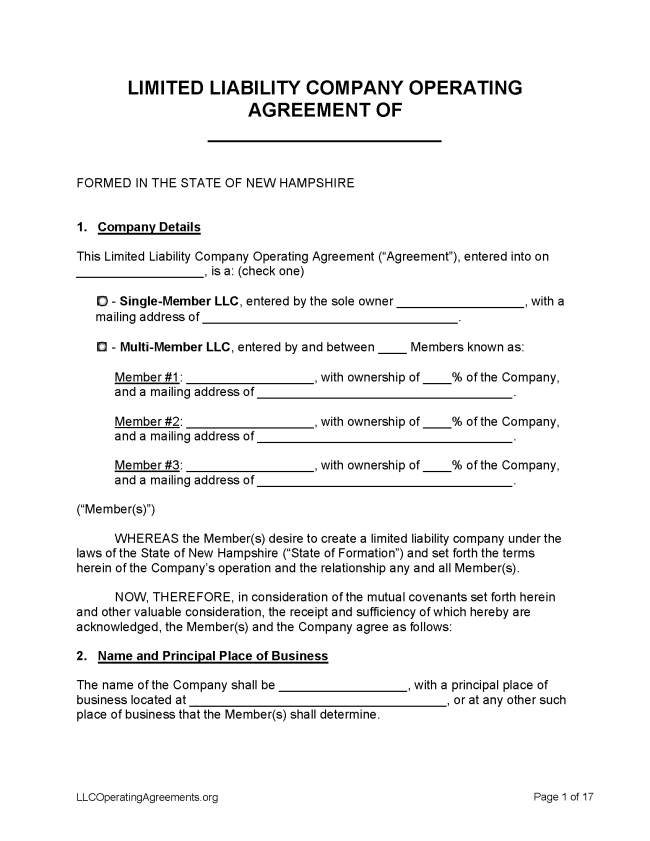

A New Hampshire LLC operating agreement is a legal form that establishes the ownership structure, operating procedures, and policies of a limited liability company (LLC) in New Hampshire. The document outlines how the company will be run and dissolved, as well as how profits, losses, and salaries will be handled, among other matters. The agreement can help to resolve legal disputes.

By Type (2)

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in New Hampshire

- Filing fee: $100

- Processing time: 30 days

1. Choose a Name

New Hampshire law states that an LLC name can be reserved for an applicant’s exclusive use for 120 days. The 120-day period can be renewed or extended by the applicant (§ 304-C:27).

2. Choose an LLC Type

Domestic LLC – For an LLC located within New Hampshire.

- Online Filing – Create a free QuickStart account, then select “Create a Business Online” beneath “Business Services.”

- Paper Filing (Form LLC-1) – Mail a completed Certificate of Formation form, plus payment for the filing fee, to Corporation Division, NH Dept. of State, 107 N Main St, Rm 204, Concord, NH 03301-4989. An alternative to mailing the application is to hand-deliver to State House Annex, 3rd Floor, Rm 317, 25 Capitol St, Concord, NH.

Foreign LLC – For an LLC located outside New Hampshire.

- Online Filing – Create a free QuickStart account, then select “Create a Business Online” beneath “Business Services.”

- Paper Filing (FLLC-1) – Mail a completed Application for Foreign Limited Liability Company Registration form, plus payment for the filing fee, to Corporation Division, NH Dept. of State, 107 N Main St, Rm 204, Concord, NH 03301-4989. An alternative to mailing the application is to hand-deliver to State House Annex, 3rd Floor, Rm 317, 25 Capitol St, Concord, NH.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $15

A name that is distinguishable from other names already registered to other entities can be reserved for 120 days during the process of forming the LLC (§ 304-C:27).

- Online Filing – Create a free QuickStart account, then select “Business Services.”

- Paper Filing (Form 1) – Fill out an Application for Reservation of Name using black print or type, then submit with the filing fee. Checks can be made payable to State of New Hampshire. If mailing, use this address: Corporation Division, NH Dept. of State, 107 N Main St, Rm 204, Concord, NH 03301-4989. If delivering in person, use this one: State House Annex, 3rd Floor, Rm 317, 25 Capitol St, Concord, NH.

Renewing an LLC (Annual Report)

Filing fee: $100

Every LLC must file an annual report by January 1 of each year in order to continue operating (§ 304-C:194).

- Online Filing – Enter the business name or business ID, then click “Search.” Payment can be made with a credit card. Only online filing is available.

Dissolving an LLC

Filing fee: $35

To formally dissolve an LLC, a certificate of cancellation of the certificate of formation should be filed with the secretary of state (§ 304-C:142).

- Online Filing – Log into QuickStart and search for business name.

- Paper Filing (Form LLC-7) – Send a completed Certificate of Cancellation form, plus payment for the filing fee, to Corporation Division, NH Dept. of State, 107 N Main St, Rm 204, Concord, NH 03301-4989. If delivering in person, use this address: State House Annex, 3rd Floor, Rm 317, 25 Capitol St, Concord, NH.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means any agreement, including any amendments or restatements, whether referred to as a limited liability company agreement, operating agreement, or otherwise, of the member or members as to the internal affairs of a limited liability company or the conduct of its business.