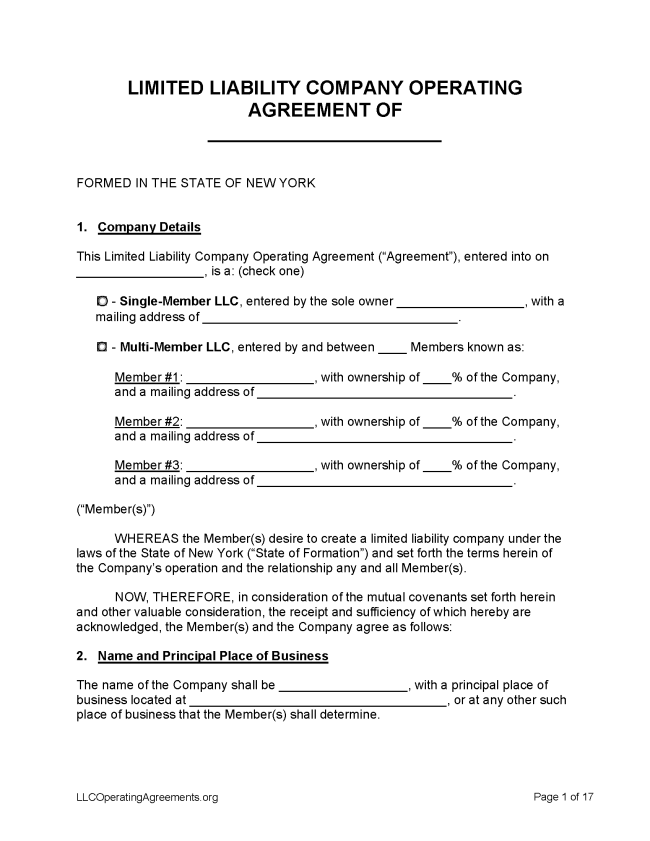

A New York LLC operating agreement is a legal document that governs the operations of a limited liability company (LLC) in New York. Many states do not require businesses to have operating agreements before operating; however, in New York, these are required. Operating agreements establish the policies, procedures, and ownership structure of the LLC.

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in New York

- Filing fee: $200 (domestic LLCs), $250 (foreign LLCs)

- Processing time: 4 months. For a list of expedited processing fees, click here.

1. Choose a Name

A name can be reserved for 60 days while the LLC is being formed (§ 205). Search the state’s Corporation and Business Entity Database to determine whether a desired name is already registered to another entity. For instructions pertaining to the search, click here.

2. Choose an LLC Type

Domestic LLC – For an LLC located within New York.

- Online Filing – Select “Domestic Business Corporation (For Profit) and Domestic Limited Liability Company” from the “On-Line Filings for 3rd Party Non-Service Company Filers” heading.

- Paper Filing (Form DOS-1336-f) – Mail a completed Articles of Organization form, plus the filing fee, to the Department of State Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza 99 Washington Ave. Albany, NY 12231-0001. Checks can be made payable to the Department of State. Form should be typed or completed in black ink.

Foreign LLC – For an LLC located outside New York.

- Paper Filing (Form DOS-13610-f-a) – Mail a completed Application for Authority to the Department of State Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza 99 Washington Ave. Albany, NY 12231-0001. Checks can be made payable to the Department of State. Form should be typed or completed in black ink.

3. Post-Formation

Once the paperwork has been processed, several documents must be filed.

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Notice should be published in two newspapers for six consecutive weeks. An affidavit of publication must be obtained from the publisher of each newspaper and a Certificate of Publication must be submitted to the Department of State with a $50 filing fee.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $20

A name can be reserved for 60 days while the LLC is being formed (§ 205).

- Paper Filing (Form DOS-1233-f-a) – Mail an Application for Reservation of Name plus the filing fee to the Department of State Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza 99 Washington Ave. Albany, NY 12231-0001.

Renewing an LLC (Biennial Statement)

- Filing fee: $9

Domestic and foreign LLCs in New York must file a biennial statement every two years with the New York Department of State (§ 301). Statements are due on the calendar month of the LLC’s original formation.

- Online Filing – Enter the DOS ID number and business name, then select “Submit.”

- Paper Filing – Contact the Statement Unit of the New York Department of State’s Division of Corporations by e-mail to obtain a paper biennial statement form. Include the exact name of the LLC and its date of formation or DOS ID number.

Dissolving an LLC

Filing fee: $60

An LLC can be terminated through the filing of articles of dissolution (§ 705).

- Paper Filing (Form 1366-f) – Completed Articles of Dissolution, together with the filing fee, should be mailed to New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means any written agreement of the members

concerning the business of a limited liability company and the conduct

of its affairs and complying with section four hundred seventeen of this

chapter.