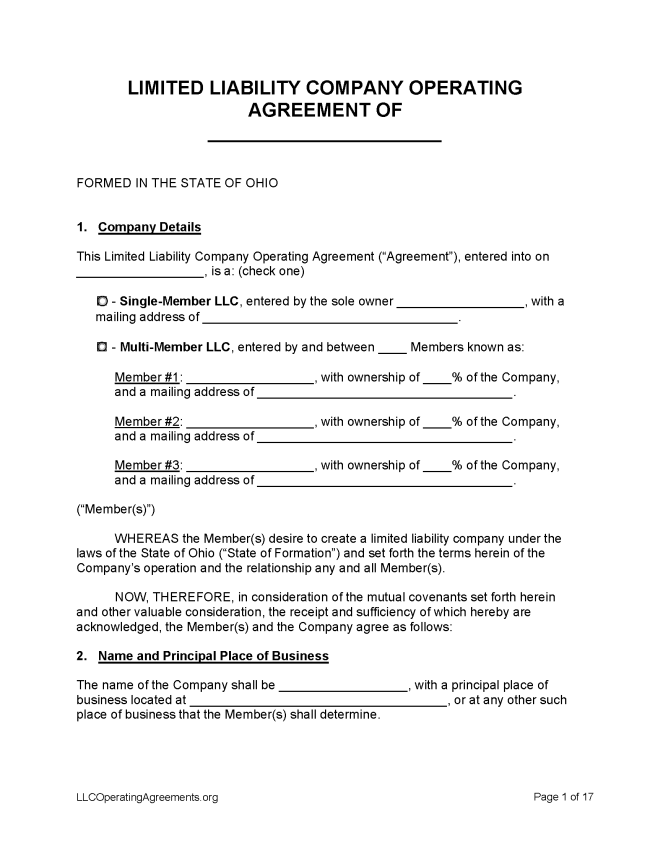

An Ohio LLC operating agreement is a legal document that clarifies the way a limited liability company (LLC) in Ohio will be owned, managed, operated, run, and dissolved. The agreement outlines such matters as how accounting and finances will be handled, how membership interests can be transferred, and who is responsible for which duties. Each member should keep a copy on file.

By Type (2)

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Ohio

- Filing fee: $99

- Processing time: 3-7 business days

1. Choose a Name

The first step is to reserve a name in order that it remains when the paperwork has been processed and the LLC has been officially registered. The State of Ohio allows applicants to reserve a name, if the name is distinguishable enough from other names already registered with the state, for a period of 180 days. Check the state’s database to determine whether a desired name has already been registered.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Ohio.

- Online Filing – Select “Submit a business filing,” then create a new profile to begin.

- Paper Filing (Form 610) – Complete the cover letter and Initial Articles of Corporation form and mail, along with payment, to P.O. Box 670, Columbus, OH 43216.

Foreign LLC – For an LLC located outside Ohio.

- Online Filing – Select “Submit a business filing,” then create a new profile to begin.

- Paper Filing (Form 617) – Complete the cover letter and Foreign For-Profit Corporation Application for License form and mail, along with payment, to P.O. Box 670, Columbus, OH 43216. Per state law, a foreign for-profit LLC must also file a certificate of good standing or subsistence dated not earlier than 90 days prior to the filing of the application.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $39

If an application for a name reservation is approved, the state will reserve a name for the applicant’s exclusive use for 180 days (§ 1702.05).

- Online Filing – Select “Submit a business filing,” then create a profile or log in.

- Paper Filing (Form 534B) – Complete the cover letter and Name Reservation / Transfer / Cancellation form, which must be typed, and then enclose payment for the filing fee and mail to P.O. Box 670, Columbus, OH 43216. Make checks payable to Secretary of State.

Renewing an LLC (Annual Report)

Business entities in Ohio are not required to file annual reports in order to continue doing business each year.

Dissolving an LLC

Filing fee: $50

Per Ohio law, an LLC can be dissolved upon delivery of a certificate of dissolution to the secretary of state for filing (§ 1706.471). Notice that the company was dissolved must also be published on the website of the secretary of state (§ 1706.474).

- Online Filing – Select “Submit a business filing,” then sign into the account under which the LLC is registered.

- Paper Filing for Domestic LLCs (Form 616) – Complete and sign the Certificate of Dissolution, then send it and payment to P.O. Box 670, Columbus, OH 43216. Make checks payable to Secretary of State.

- Paper Filing for Foreign LLCs (Form 618) – Select 618 (PDF) next to “Limited Liability Company” beneath the “Cancelling or surrendering a foreign entity registration of license” heading.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means any valid agreement, written or oral, of the members, or any written declaration of the sole member, as to the affairs and activities of a limited liability company and any series thereof. “Operating agreement” includes any amendments to the operating agreement.