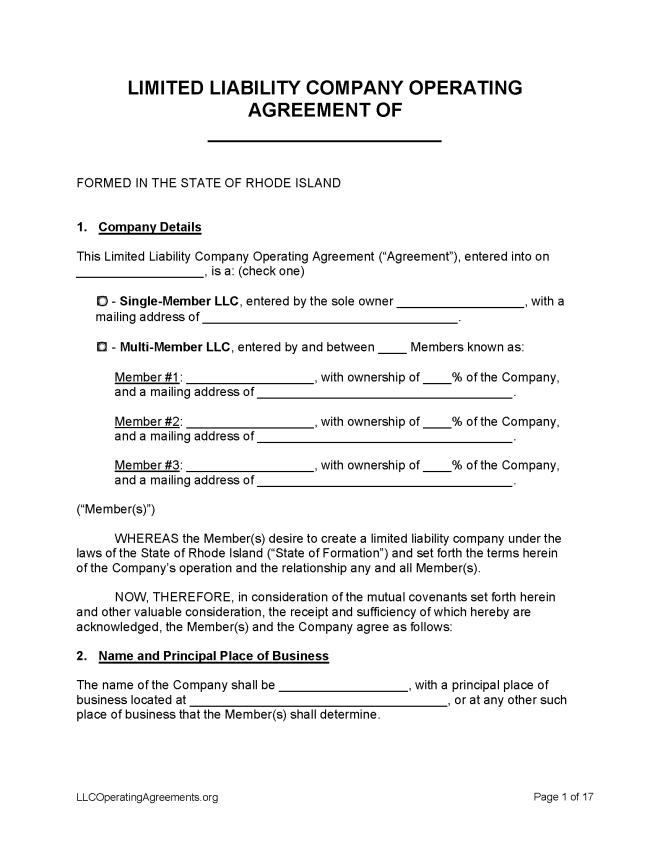

A Rhode Island LLC operating agreement is a legal document that outlines how a limited liability company (LLC) in Rhode Island will work in terms of its internal structure and the way it conducts business. The document is not legally required, but highly recommended because it can mitigate the risk of conflict among multiple owners and also protect owners’ assets from claims made against the company. In short, the agreement formalizes the LLC’s ownership, management, and operations.

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Rhode Island

- Filing fee: $150

- Processing time: 1-3 business days

1. Choose a Name

Any person can reserve the use of a name for an LLC as the process of forming the LLC is underway (§ 7-16-10). A name reservation will only be accepted if the name is distinguishable and sufficiently dissimilar from names already registered to other entities. To check whether a name is already taken, browse the state’s Historic Corporate Catalog.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Rhode Island.

- Online Filing – Fill out the online form, then select “Click HERE to Submit This Information.”

- Paper Filing (Form 400) – Complete the Articles of Organization for a Domestic Limited Liability Company, which must be typed, and then send along with the filing fee to Business Services Division, 148 W. River Street, Ste. 1, Providence, RI 02904. Checks should be made out to RI Department of State.

Foreign LLC – For an LLC located outside Rhode Island.

- Online Filing – Select “Register your Business in RI.”

- Paper Filing (Form 450) – Mail a completed Application for Registration and the filing fee to Business Services Division, 148 W. River Street, Ste. 1, Providence, RI 02904. Checks should be made out to RI Department of State. Check the second page of the form to determine whether or not your specific LLC is required to submit additional information; this will depend on the nature of its business.

3. Post-Formation

Once the paperwork has been processed, several documents must be filed.

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $50

Any person can reserve an LLC name for a period of 120 days, provided the name is dissimilar from names already registered in Rhode Island (§ 7-16-10).

- Online Filing – Select “Reserve a Name” beneath the “New Entities” heading.

- Paper Filing (Form 620) – Mail a completed Application for Reservation of Entity Name plus the filing fee to Business Services Division, 148 W. River Street, Ste. 1, Providence, RI 02904.

Renewing an LLC (Annual Report)

- Filing fee: $50

Every LLC in Rhode Island is required to file an annual report each year between February 1 and May 1 (§ 7-16-66). Failure to report may result in the LLC’s Certificate of Organization being revoked.

- Online Filing – Log in using the CID and PIN and then follow the prompts to file an annual report online.

- Paper Filing (Form 632) – A completed Annual Report form plus the filing fee should be sent to Business Services Division, 148 W. River Street, Ste. 1, Providence, RI 02904. Checks should be made out to RI Department of State. Late reports will incur an additional $25 fee.

Dissolving an LLC

Filing fee: $50

Articles of dissolution should be filed with the secretary of state not later than 30 days after the LLC is wound up and dissolved (§ 7-16-47).

- Online Filing – Follow the instructions on this page to dissolve an LLC in Rhode Island.

- Paper Filing (Form 404) – Complete the Articles of Dissolution form and send it, along with payment for the filing fee, to Business Services Division, 148 W. River Street, Ste. 1, Providence, RI 02904. Checks should be made out to RI Department of State.