A Texas LLC operating agreement is a legal form that outlines the affairs or conduct of the business of a limited liability company (LLC) in Texas. The document is also known in Texas as a company agreement. The document can help to mitigate disputes and clarify owners’ interests, rights, and responsibilities as well as the way financial and other matters, including dissolution, will be handled.

By Type (2)

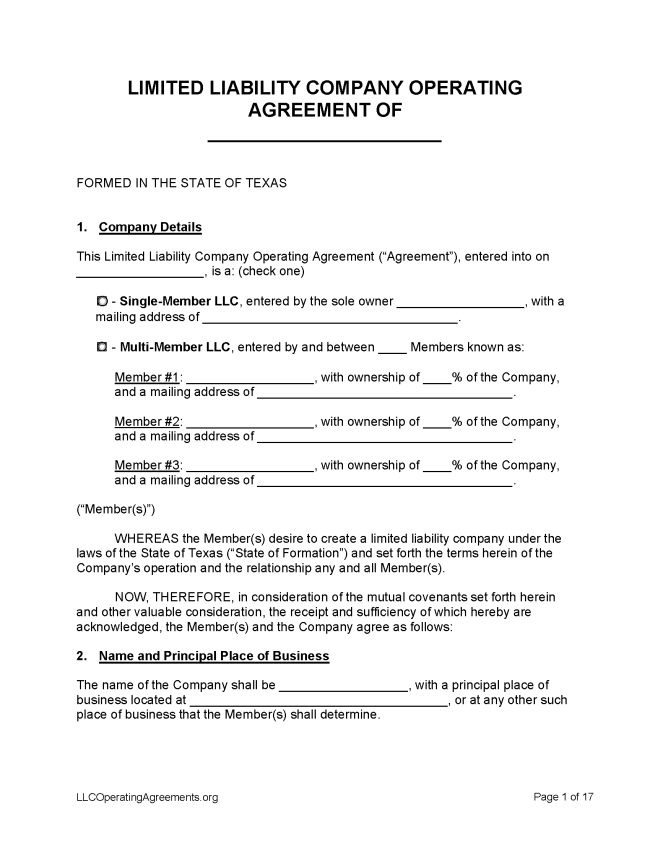

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Texas

- Filing fee: $300 (domestic LLCs), $750 (foreign LLCs)

- Processing time: 70-72 business days

1. Choose a Name

A business name can be reserved in Texas for 120 days. To determine whether the business name is available, call (512) 463-5555, dial 711 for relay services, or e-mail a name inquiry to corpinfo@sos.texas.gov.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Texas.

- Online Filing – Create an account and upload only the document. Payment can be made with a credit card.

- Paper Filing (Form 205) – Submit the completed form in duplicate along with the filing fee to P.O. Box 13697, Austin, TX 78711-3697 or delivered to the James Earl Rudder Office Building, 1019 Brazos, Austin, TX 78701.

Foreign LLC – For an LLC located outside Texas.

- Online Filing – Create an account and upload only the document. Payment can be made with a credit card.

- Paper Filing (Form 304) – Mail a completed Application for Registration of a Foreign Limited Liability Company in duplicate along with the filing fee to P.O. Box 13697, Austin, TX 78711-3697 or delivered to the James Earl Rudder Office Building, 1019 Brazos, Austin, TX 78701.

3. Post-Formation

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $40

A name may be reserved for an applicant’s exclusive use for 120 days (Subchapter C, § 5.101 – 104).

- Online Filing – Scroll down and select “enter site.”

- Paper Filing (Form 501) – Mail a completed Application for Reservation or Renewal of Reservation of an Entity Name to P.O. Box 13697, Austin, TX 78711-3697 or delivered to the James Earl Rudder Office Building, 1019 Brazos, Austin, TX 78701.

Renewing an LLC

Texas does not require LLCs to file annual reports in order to continue operating. However, LLCs must file a Public Information Report each year with the Texas Comptroller of Public Accounts. This is part of the entity’s franchise tax report.

Dissolving an LLC

Filing fee: $40

- Online Filing – Scroll down and select “enter site.”

- Paper Filing (Form 651) – Submit two signed copies of the certificate of termination to P.O. Box 13697, Austin, Texas 78711-3697 or deliver them to the James Earl Rudder Office Building, 1019 Brazos, Austin, TX 78701.