A Washington LLC operating agreement is a legal document that outlines how a limited liability company (LLC) in Washington will conduct its business. The form contains such information as ownership structure, how ownership can be transferred, how profits and losses will be handled, and how the company will be dissolved if it comes to that. Every company owner is advised to keep a copy on file.

By Type (2)

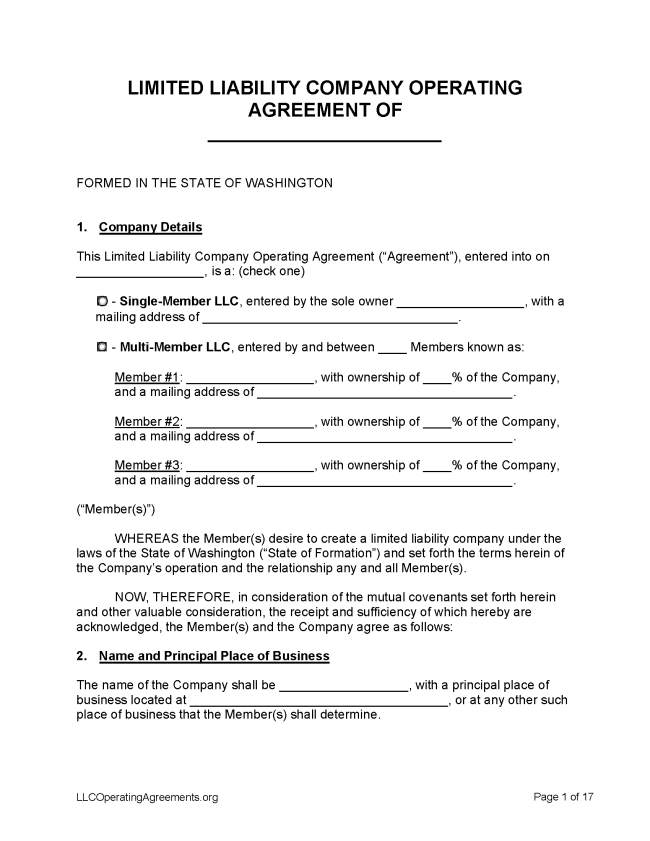

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Washington

- Filing fee: $200 (online filings), $180 (paper filings)

- Processing time: 2 business days

1. Choose a Name

The first step in forming an LLC in Washington is to reserve a name for the LLC’s exclusive use. Use the state’s Business Lookup tool to figure out whether proposed names are available or not. Then submit a Name Reservation request, either online or by mail, to the secretary of state.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Washington.

- Online Filing – Create a user account to file online. Watch this video for filing instructions.

- Paper Filing – Complete the Certificate of Formation form and send, along with the filing fee, to P.O. Box 40234, Olympia, WA 98504-0234.

Foreign LLC – For an LLC located outside Washington.

- Online Filing – Create a user account to file online. Watch this video for filing instructions.

- Paper Filing – Complete the Foreign Registration Statement form and send, along with the filing fee, to P.O. Box 40234, Olympia, WA 98504-0234.

3. Post-Formation

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Initial Report – Within 120 days of being registered, LLCs must deliver to the secretary of state an initial report containing the elements outlined in § 23.95.255. Click here for an initial report form.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $30

An LLC name can be reserved with the submission of a Name Reservation form to the Secretary of State (§ 25.15.016).

- Online Filing – Register for a new account to reserve a name online. Learn how to create an account here.

- Paper Filing – Complete the Name Reservation form and mail with filing fee to Secretary of State Corporation Division, 801 Capitol Way S, P.O. Box 40234, Olympia WA 98504-0234.

Renewing an LLC (Annual Report)

- Filing fee: $60

LLCs in Washington are required to deliver initial and annual reports to the secretary of state (§ 25.15.106).

- Online Filing – Log into user account to file an annual report online.

- Paper Filing – Mail a completed Annual Report form and filing fee to Secretary of State Corporation Division, 801 Capitol Way S, P.O. Box 40234, Olympia WA 98504-0234. Make checks payable to Secretary of State.

Dissolving an LLC

Filing fee: None

The LLC must deliver a certificate of dissolution to the secretary of state in order to be formally dissolved (§ 25.15.269).

- Paper Filing (Domestic LLCs) – Mail a completed Certificate of Dissolution to 801 Capitol Way S, Olympia, WA 98504-0234.

- Paper Filing (Foreign LLCs) – Mail a completed Certificate of Dissolution to 801 Capitol Way S, Olympia, WA 98504-0234.

Statutes

“LLC Company Agreement” Definition