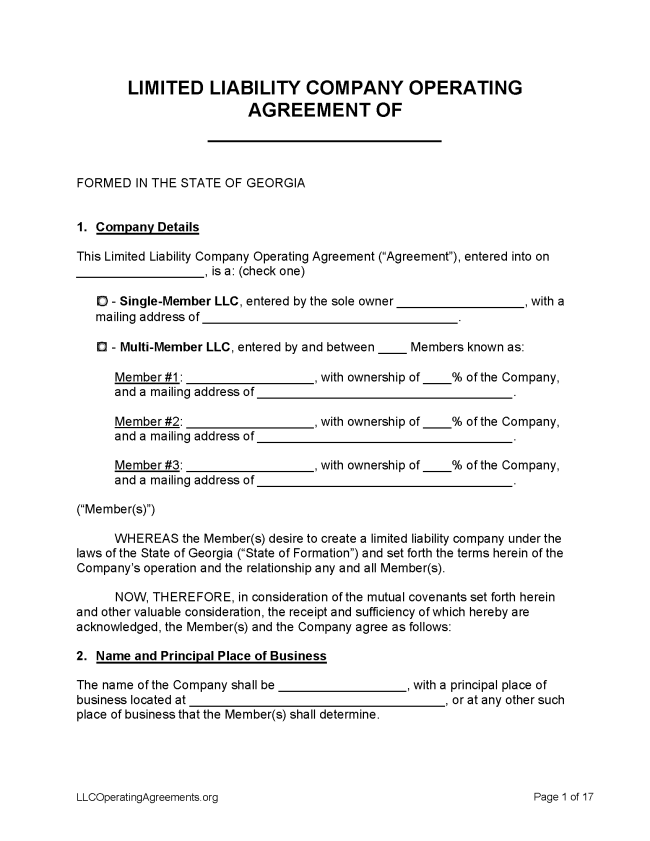

A Georgia LLC operating agreement is a form that establishes the ownership, management, and operations of a limited liability company (LLC) in Georgia. The document clarifies matters as a means of preventing future disputes among members and has the added benefit of protecting company owners’ personal property from claims filed in court against the LLC. Every owner is advised to keep a copy of the operating agreement on file.

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Georgia

- Filing fee: $100 (plus $10 for filing by paper) for online, $225 for foreign (plus $10 for filing by paper)

- Processing time: 7 business days (online), 15 business days (paper)

1. Choose a Name

Before the process of forming an LLC is complete, it can be wise to reserve an entity name. This can be done online or via a Name Reservation Request form. The name, if approved, can be reserved for a nonrenewable period of 30 days. A name certificate will be sent to the applicant in this case.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Georgia.

- Online Filing – Create a user account, then select “Create or register a business.” Choose “domestic limited liability company” and complete the form. Pay the filing fee by credit card.

- Paper Filing (Form CD030) – Mail or deliver the completed form, along with a transmittal form (CD231) and a payment of $110, to Corporations Division, 2 Martin Luther King Jr. Dr. SE, Suite 313 West Tower, Atlanta GA 30334. Checks can be made payable to the Georgia Secretary of State.

Foreign LLC – For an LLC located outside California.

- Online Filing – Create a user account, then select “Create or register a business.” Choose “I am registering a foreign (non-Georgia) business,” then fill out the required information.

- Paper Filing (Form CD241) – Mail or deliver the completed Application for Certificate of Authority for Foreign Limited Liability Company, along with a payment of $235, to Corporations Division, 2 Martin Luther King Jr. Dr. SE, Suite 313 West Tower, Atlanta GA 30334. Checks can be made payable to the Georgia Secretary of State.

3. Post-Formation

Once the paperwork has been processed, several documents must be filed.

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $25 (plus $10 for paper filing)

Upon being approved, a name is reserved for 30 days (O.C.G.A. Rule 590-7-2-.03).

- Online Filing – Apply to reserve a name online and pay the $25 filing fee using a credit card.

- Paper Filing – Mail a Name Reservation Request form and filing fee of $35.00 ($25 filing fee + $10 paper filing service charge) to Office of Secretary of State, Corporations Division, Name Reservation Request, 2 Martin Luther King Jr. Dr. SE, Suite 313 West Tower, Atlanta GA 30334.

Renewing an LLC (Annual Registration)

Filing fee: $50

Every LLC must file an annual registration with the Secretary of State before April 1 each year (Rule 590-7-1-.11). The first is due in the year following the calendar year during which the LLC was formed. Per state statute, an LLC that does not submit an annual registration can be dissolved and the fee to reinstate a dissolved LLC is $250. Annual registration filings can be completed three years in advance. For more information about annual registrations in Georgia, click here.

- Online Filing – Create an account, then select which years to file for and search for LLC by name.

- Paper Filing – Follow the instructions for printing the form, then submit the completed form and a check or money order to the Secretary of State, Corporations Division, 2 Martin Luther King Jr. Dr. SE, Suite 313 West Tower, Atlanta GA 30334.

Dissolving an LLC

Filing fee: None for online filings, $10 for paper filings

An LLC can be terminated through the filing of a Certificate of Termination (Rule 590-7-23-.02, Rule 590-7-23-.03).

- Online Filing – Sign into user account, then search for Certificate of Termination.

- Paper Filing (Form CD415) – Send completed Certificate of Termination and $10 payment to Corporations Division, 2 Martin Luther King Jr. Dr. SE, Suite 313 West Tower, Atlanta GA 30334. Checks can be made payable to the Georgia Secretary of State.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means any agreement, written or oral, of the member or members as to the conduct of the business and affairs of a limited liability company. In the case of a limited liability company with only one member, a writing signed by that member stating that it is intended to be a written operating agreement shall constitute a written operating agreement and shall not be unenforceable by reason of there being only one person who is a party to the operating agreement. A limited liability company is not required to execute its operating agreement and, except as otherwise provided in the operating agreement, is bound by its operating agreement whether or not the limited liability company executes the operating agreement. An operating agreement may provide enforceable rights to any person, including a person who is not a party to the operating agreement, to the extent set forth therein.