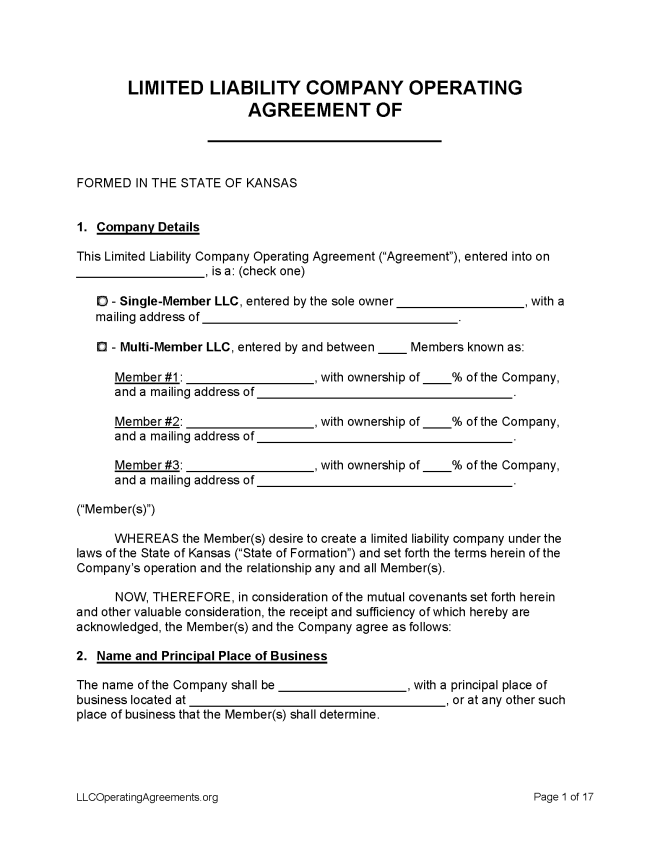

A Kansas LLC operating agreement is a legal form that clarifies the way a limited liability company (LLC) in Kansas will be owned, managed, run, and dissolved. The document, while not a requirement for the operation of the business, can resolve disputes and even offer legal protection over company owners’ private assets in the event the LLC faces a lawsuit. It is highly advisable for each owner, or member, to keep a copy of the agreement on file.

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Kansas

- Filing fee: $160 for online filing, $165 for paper filing

- Processing time: 3-5 business days

1. Choose a Name

State statute allows the Secretary of State to reserve a name for an applicant’s exclusive use for up to 120 days while the process of forming the LLC is underway (§ 17-7923). To reserve a name, visit the state’s Business Entity Search Station to check on its availability. Next, create a KansAccess account, then visit the Business Center and scroll down to select “Name Reservation.”

2. Choose an LLC Type

Domestic LLC – For an LLC located within Kansas.

- Online Filing – Create a KansAccess account, then select “Kansas Business Entity Formation” and follow the prompts.

- Paper Filing (Form DL5109) – Mail or deliver a completed Articles of Organization form and the $165 filing fee to the Secretary of State at Memorial Hall, 1st Floor, 120 S.W. 10th Avenue, Topeka, KS 66612-1594.

- Cash is not accepted and checks should be made out to Secretary of State. Documents can be faxed to Business Services, (785) 296-4570 for an additional $20 processing fee.

Foreign LLC – For an LLC located outside Kansas.

- Online Filing – Create a KansAccess account, then select “Kansas Business Entity Formation” and follow the prompts.

- Paper Filing – Mail a completed Application for Registration of Foreign Covered Entity, plus a $165 filing fee, to the Secretary of State at Memorial Hall, 1st Floor, 120 S.W. 10th Avenue, Topeka, KS 66612-1594.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the corporation’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $30

Kansas law allows the Secretary of State to reserve a name for an applicant’s exclusive use for 120 days (§ 17-7923). Once the application has been lodged and approved, the selected name cannot be used by any other entity. Applicants are advised to conduct a search for available names before applying to reserve a name. The names of entities that have dissolved remain unavailable for one year.

- Online Filing – To reserve a name, create a KansAccess account, then visit the Business Center and select “Name Reservation.”

Renewing an LLC (Annual Report)

Filing fee: $55

Each year, an LLC must file an annual report with the Secretary of State in order to renew its registration. By failing to file an annual report, an LLC risks being dissolved (§ 17-76,139).

- Online Filing – Enter the business entity name and I.D. number, which can be found through the Business Entity Search Station, in order to file an annual report online.

- Paper Filing (Form LC 50) – A completed Form LC 50, plus a payment for the filing fee, should be sent to the Secretary of State at Memorial Hall, 1st Floor, 120 S.W. 10th Avenue, Topeka KS 66612-1594.

Dissolving an LLC

Filing fee: $20

An LLC is dissolved when a Certificate of Cancellation is filed with the Secretary of State (§ 17-76,144).

- Online Filing – Enter the business entity name and I.D. number, then follow the prompts to dissolve an LLC online.

- Paper Filing – A completed Certificate of Cancellation form, plus a payment for the filing fee, should be sent to the Secretary of State at Memorial Hall, 1st Floor, 120 S.W. 10th Avenue, Topeka KS 66612-1594.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means any agreement, whether referred to as an operating agreement, limited liability company agreement or otherwise, written, oral, or implied, of the member or members as to the affairs of a limited liability company and the conduct of its business. A member or manager of a limited liability company or an assignee of a limited liability company interest is bound by the operating agreement whether or not the member or manager or assignee executes the operating agreement. A limited liability company is not required to execute its operating agreement. A limited liability company is bound by its operating agreement whether or not the limited liability company executes the operating agreement. An operating agreement of a limited liability company having only one member shall not be unenforceable by reason of there being only one person who is a party to the operating agreement. An operating agreement is not subject to any statute of frauds, including K.S.A. 33-106, and amendments thereto. An operating agreement may provide rights to any person, including a person who is not a party to the operating agreement, to the extent set forth therein. A written operating agreement or another written agreement or writing: