An Oregon LLC operating agreement is a legal document that lays out how a limited liability company (LLC) in Oregon will conduct its business. The agreement covers such matters as ownership, management, and dissolution, as well as others. Each owner is advised to keep a copy on file.

By Type (2)

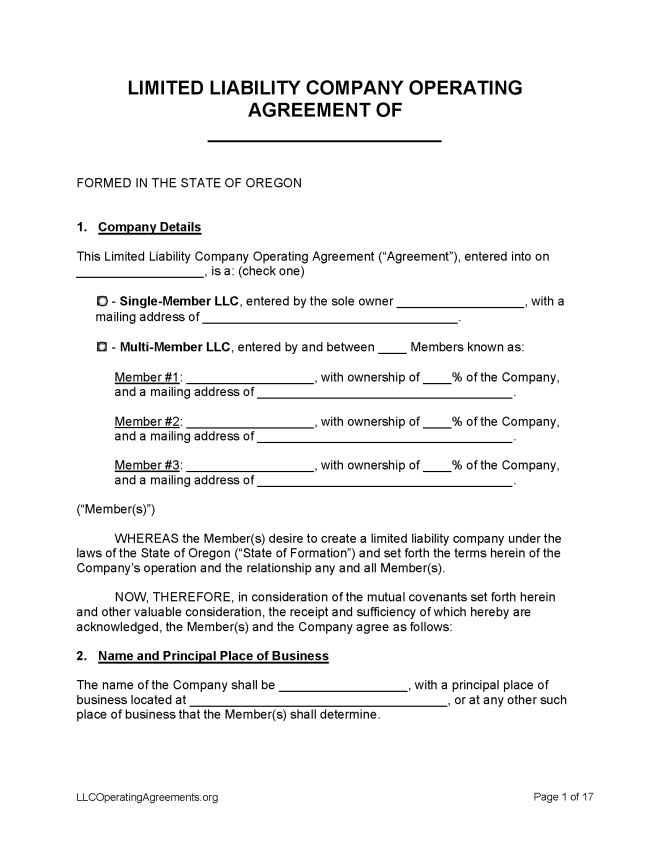

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Oregon

- Filing fee: $100 (domestic LLCs), $275 (foreign LLCs)

- Processing time: 4-6 weeks

1. Choose a Name

The State of Oregon will reserve a name for up to 120 days (§ 63.097). Before beginning the process of creating an LLC, it’s a good idea to reserve a name. Check whether the name under consideration is available or registered to another entity by clicking here.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Oregon.

- Online Filing – Select “New User” to create a new account, then fill out required fields.

- Paper Filing – Mail a completed Articles of Organization form plus the filing fee to Corporation Division, 255 Capitol St. NE, Suite 151, Salem, OR 97310-1327. See instructions pertaining to the Articles of Organization form here.

Foreign LLC – For an LLC located outside Oregon.

- Online Filing – Select “New User” to create a new account, then fill out required fields.

- Paper Filing – Mail a completed Application for Authority to Transact Business form plus a filing fee to Corporation Division, 255 Capitol St. NE, Suite 151, Salem, OR 97310-1327. Include a certificate of existence from the entity’s home jurisdiction.

3. Post-Formation

Once the paperwork has been processed, several documents must be filed.

- LLC Operating Agreement – This agreement will codify the corporation’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $100

This will hold the name for the applicant’s exclusive use for 120 days (§ 63.097).

- Paper Filing – Mail a completed Application for Name Reservation to Corporation Division, 255 Capitol St. NE, Suite 151, Salem, OR 97310-1327. Make checks payable to Corporation Division.

Renewing an LLC (Annual Report)

- Filing fee: $100

Every domestic LLC and every foreign LLC must deliver an annual report to the Office of the Secretary of State each year (§ 63.787). Not filing an annual report is risking dissolution.

- Online Filing – In Oregon, only online filing is available for annual reports. Enter the LLC’s registry number, then select “Retrieve Renewal Detail.”

Dissolving an LLC

Filing fee: $100

An LLC can be formally dissolved through the delivery of articles of dissolution to the Office of the Secretary of State (§ 63.631).

- Paper Filing – Complete the bottom half of the form, beginning with “Articles of Dissolution Only.” Mail with the filing fee to Corporation Division, 255 Capitol St. NE, Suite 151, Salem, OR 97310-1327.