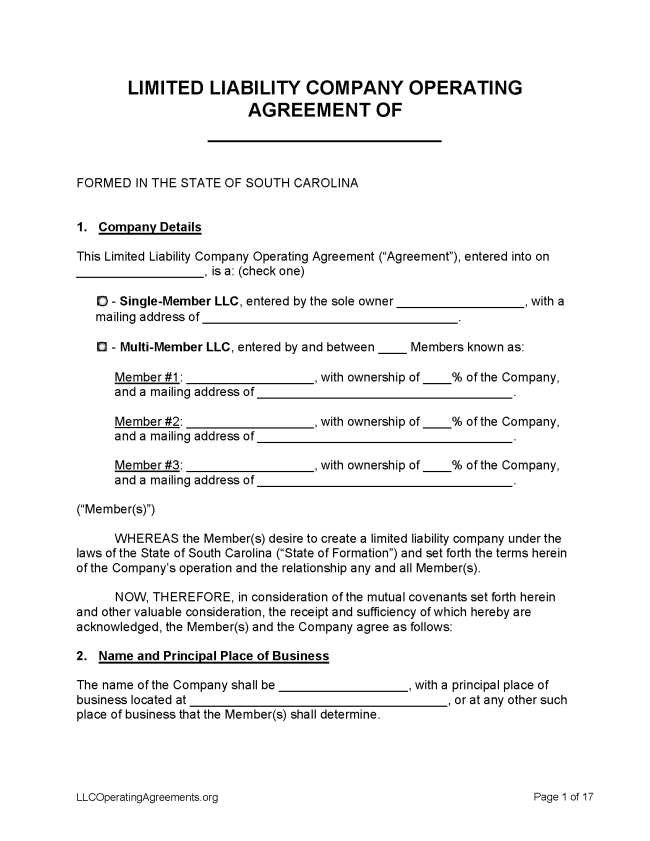

A South Carolina LLC operating agreement is a legal form that puts into place an ownership structure, policies, and operating procedures for a limited liability company (LLC) in South Carolina. It contains information about the company, its owners, tax treatment, accounting, and guidelines for major events it may encounter, including dissolution. The agreement can act as a hedge against disputes as it separates the liability of the owner from that of the entity.

By Type (2)

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in South Carolina

- Filing fee: $135

- Processing time: 24 hours (online filings), 2-3 business days (paper filings)

1. Choose a Name

The first step is to choose a name for the LLC, which can be reserved for a period of 120 days until the LLC is formally registered. First, use the state’s Business Name Search platform to determine whether the desired name is available or already registered to another entity.

2. Choose an LLC Type

Domestic LLC – For an LLC located within South Carolina.

- Online Filing – Select “Add New Entity.”

- Paper Filing (Form F0001) – Select Articles of Incorporation and fill out the form. Send two copies of the completed form plus the filing fee to the Secretary of State, 1205 Pendleton Street, Suite 525, Columbia, SC 29201.

Foreign LLC – For an LLC located outside South Carolina.

- Online Filing – Select “Add New Entity.”

- Paper Filing (Form F0002) – Select Application for a Certificate of Authority to Transact Business and fill out the form. Send two copies of the completed form plus the filing fee to the Secretary of State, 1205 Pendleton Street, Suite 525, Columbia, SC 29201. Include a completed South Carolina Initial Annual Report of Corporations (Form CL-1).

3. Post-Formation

Once the paperwork has been processed, several documents must be filed.

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $25

Any person can reserve an LLC name for 120 days (§ 33-44-106).

- Online Filing – Select “Reserve a Name” beneath the “New Entities” heading.

- Paper Filing (Form F0038) – Mail two copies of the completed Application to Reserve a Limited Liability Company Name to Secretary of State, Attn: Corporate Filings, 1205 Pendleton Street Suite 525, Columbia, SC 29201.

Renewing an LLC (Annual Report)

South Carolina does not require LLCs to file annual reports each year in order to continue operating.

Dissolving an LLC

Filing fee: $10

Articles of termination must be filed with the secretary of state in order for an LLC to be officially dissolved (§ 33-44-805).

- Paper Filing for Domestic LLCs (Form F0049) – Complete the Articles of Dissolution form and send it, along with payment for the filing fee and a self-addressed stamped envelope, to SC Secretary of State, Attn: Corporate Filings, 1205 Pendleton Street, Suite 525, Columbia, SC 29201.

- Paper Filing for Foreign LLCs (Form F0031) – Complete the Application for Surrender of Authority to Do Business in the State of South Carolina form and send it, along with payment for the filing fee and a self-addressed stamped envelope, to SC Secretary of State, Attn: Corporate Filings, 1205 Pendleton Street, Suite 525, Columbia, SC 29201.