An Idaho LLC operating agreement is a legal form that binds the owners of a limited liability company (LLC) to some policies and practices agreed upon at the beginning of the company’s life. The document can prevent and mitigate disputes, as well as protect each owner’s personal assets from claims made against the company. It is highly advisable for each owner, or member, to retain a copy of the agreement.

By Type (2)

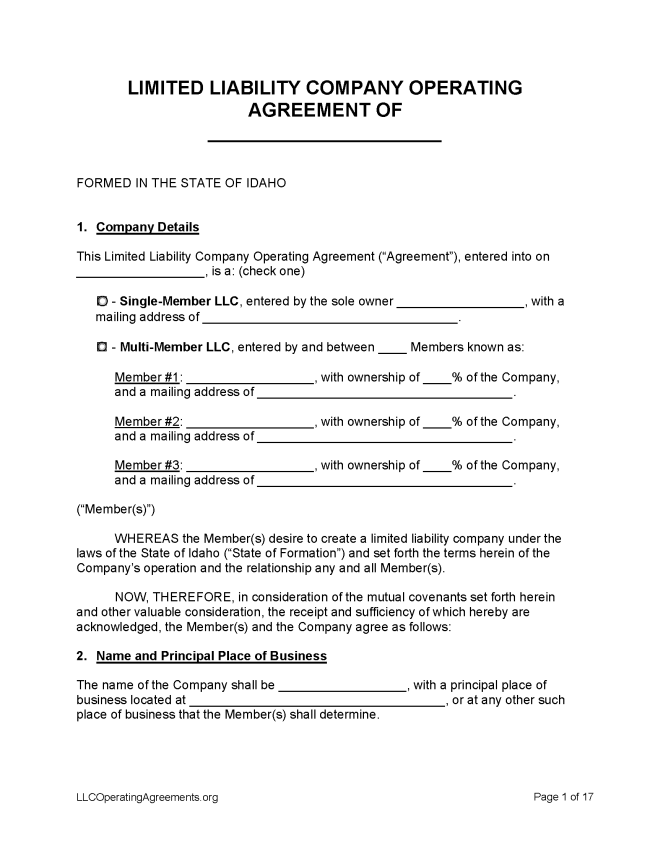

Single-Member LLC Operating Agreement

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Idaho

- Filing fee: $100 (plus $20 for paper filings)

- Processing time: 7-10 days

1. Choose a Name

To reserve an LLC name for up to 120 days while the registration paperwork gets processed, file an Application for Reservation of Legal Entity Name with the Secretary of State.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Idaho.

- Online Filing – Select “Certificate of Organization Limited Liability Company” beneath the heading “Domestic Limited Liability Companies” and select “File Online.”

- Paper Filing – Mail the completed Certificate of Organization form and the filing fee to the Office of the Secretary of State, 450 N 4th. Street, P.O. Box 83720, Boise ID 83720.

Foreign LLC – For an LLC located outside Idaho.

- Online Filing – Select “Foreign Registration Statement (Limited Liability Company)” beneath the heading “Foreign Entity Registration” and select “File Online.”

- Paper Filing – Mail the completed Certificate of Organization for, the filing fee, and a Certificate of Existence or Certificate of Goodstanding (either of these can be ordered online) to the Office of the Secretary of State, 450 N 4th. Street, P.O. Box 83720, Boise ID 83720.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $20 (plus $20 for paper filings)

State statute provides that an entity name can be reserved for the applicant’s exclusive use for up to 120 days, even before the LLC is formally registered (§ 30-21-303).

- Online Filing – Name reservations can be filed online using Idaho’s Online Business Services platform.

- Paper Filing – An Application for Reservation of Legal Entity Name can be mailed or delivered to the Office of the Secretary of State, 450 N 4th. Street, P.O. Box 83720, Boise ID 83720.

Renewing an LLC (Annual Report)

Filing fee: None

Idaho law provides that an annual report must be filed each year for an LLC before the end of the month during which the public record of the LLC became effective (§ 30-21-213).

- Online Filing – Create a SOSbiz account to file an annual report online.

- Paper Filing – Paper filing of an annual report can only be done in the Office of the Secretary of State.

Dissolving an LLC

Filing fee: None for online filing, $20 for paper filing

An LLC can be dissolved with the filing of a Statement of Dissolution with the Secretary of State (§ 30-25-702).

- Paper Filing – The completed Statement of Dissolution should be delivered, plus a $20 processing fee, to the Office of the Secretary of State, 450 N 4th. Street, P.O. Box 83720, Boise ID 83720.

Statutes

“LLC Operating Agreement” Definition