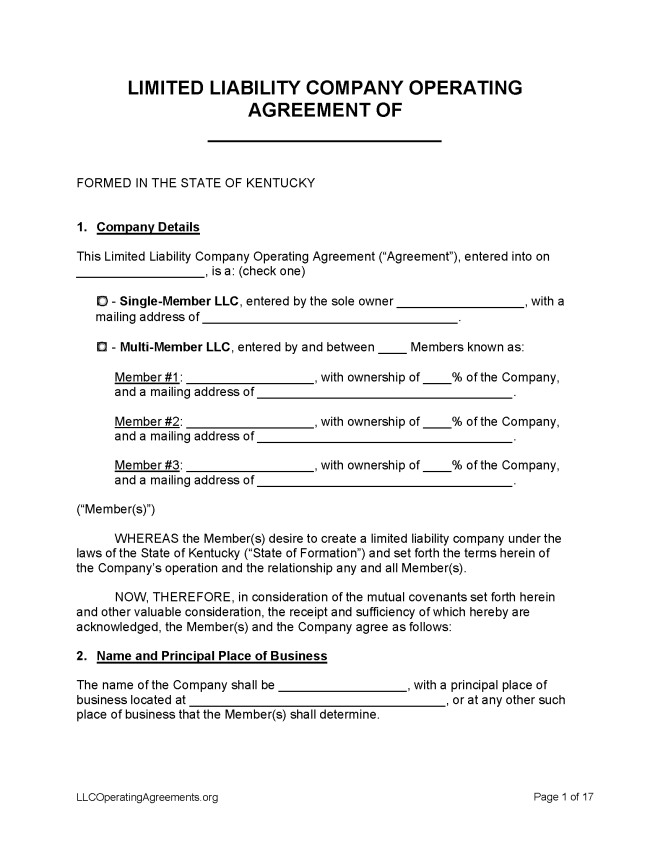

A Kentucky LLC operating agreement is a legal document that establishes the ownership, management, and operations of a limited liability company (LLC) in Kentucky. The agreement outlines such matters as how profits and losses will be handled, how membership can be transferred, and how the company will be dissolved if it comes to that. Each owner should retain a copy of the agreement, which can reduce the possibility of a dispute and also protect personal interests if the LLC faces a lawsuit.

By Type (2)

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Kentucky

- Filing fee: $90

- Processing time: 1-3 business days

1. Choose a Name

Pursuant to KRS 14A.3-020, a name can be reserved for 120 days while the process of forming the LLC is underway. An application for the reservation of a name can be mailed or delivered to the Office of the Secretary of State. To determine whether a name is available or already accounted for, an online search can be conducted here.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Kentucky.

- Online Filing – Business filings can be done online after a user account is created at Kentucky Online Gateway.

- Paper Filing – Mail a completed Articles of Organization form, plus payment for the processing fee, to Division of Business Filings, P.O. Box 718, Frankfort KY 40602.

Foreign LLC – For an LLC located outside Kentucky.

- Online Filing – Business filings can be done online after a user account is created at Kentucky Online Gateway.

- Paper Filing – Mail a completed Certificate of Authority form, plus payment for the processing fee, to Division of Business Filings, P.O. Box 718, Frankfort KY 40602.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $15

State statute provides that a name can be reserved for 120 days (KRS 14A.3-020). To determine whether a name is available or already accounted for, an online search can be conducted here. An application must be made via paper form, as online applications are not available.

- Paper Filing – A Reservation or Renewal of Reserved Name form, plus a $15 processing fee, can be lodged to reserve a name. The PDF contains filing instructions.

- The application should be sent to Michael Adams, Office of the Secretary of State, P.O. Box 718, Frankfort KY 40602, or dropped off at Room 154, Capitol Building, 700 Capital Avenue, Frankfort KY 40601 between the hours of 8:00 a.m. and 4:30 p.m. (ET).

Renewing an LLC (Annual Report)

Filing fee: $15

LLCs operating in Kentucky are required to file an annual report by June 30 each year in order to continue operating (§ 14A.6-010). The first annual report must be filed during the year in which the LLC is created, and subsequent reports must be filed between January 1 and June 30 in subsequent years.

- Online Filing – Enter the company name, then follow the prompts to file an annual report online.

- Paper Filing – An annual report can be drafted, containing information noted in § 14A.6-010, and submitted to the Secretary of State. The report should be signed, dated, and sent to the Office of the Secretary of State Filings Branch, 700 Capital Ave., P.O. Box 718, Frankfort KY 40602. A payment of $15 should be enclosed.

Dissolving an LLC

Filing fee: $40

An LLC can be formally dissolved through the filing of articles of dissolution for a domestic entity and a certificate of withdrawal for a foreign entity (§ 275.315).

- Paper Filing (Domestic) – A completed Articles of Dissolution form, together with a payment for the filing fee, should be signed, dated, and sent to the Office of the Secretary of State Filings Branch, 700 Capital Ave., P.O. Box 718, Frankfort KY 40602.

- Paper Filing (Foreign) – A completed Certificate of Withdrawal, together with payment for the filing fee, should be signed, dated, and sent to the Office of the Secretary of State Filings Branch, 700 Capital Ave., P.O. Box 718, Frankfort KY 40602.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means any agreement, written or oral, among all of the members, as to the conduct of the business and affairs of a limited liability company. If a limited liability company has only one (1) member, an operating agreement shall be deemed to include: (a) A writing executed by the member that relates to the affairs of the limited liability company and the conduct of its business regardless of whether the writing constitutes an agreement; or (b) If the limited liability company is managed by a manager, any other agreement between the member and the limited liability company as it relates to the limited liability company and the conduct of its business, regardless of whether the agreement is in writing.