A Massachusetts LLC operating agreement is a document that establishes the way a limited liability company (LLC) in Massachusetts will be owned, managed, and operated. The agreement, while not required to do business in the State of Massachusetts, is highly recommended. Not only can it prevent disputes between multiple owners, but it can also shield owners’ assets from any liabilities the company incurs.

By Type (2)

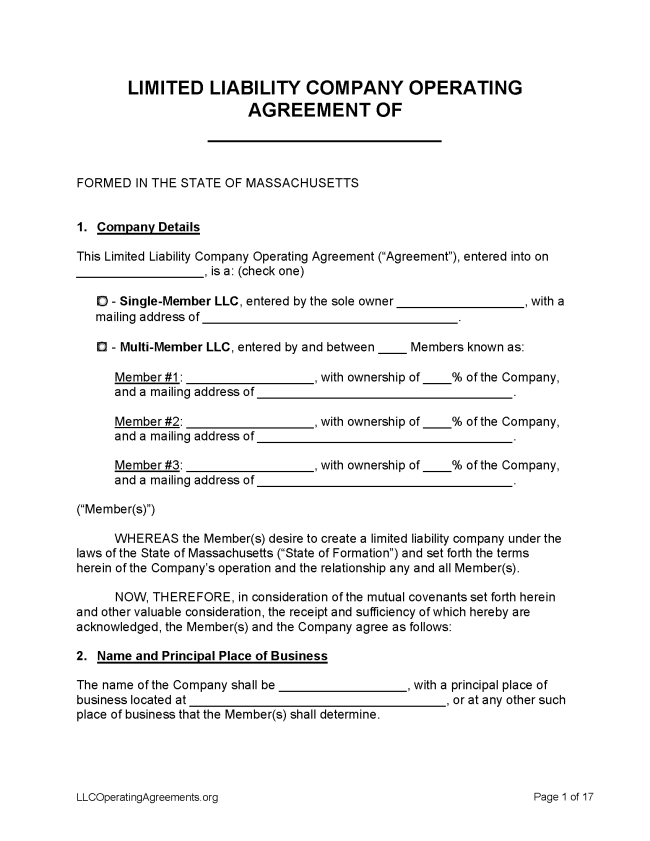

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Massachusetts

- Filing fee: $500

- Processing time: 1 business day

1. Choose a Name

A name can be reserved for 60 days and, for an additional fee, for an additional 60 days. Before lodging an application to reserve a name, check the state’s Corporate Database and Name Reservation Database to determine whether the name is already accounted for.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Massachusetts.

- Online Filing – Select “If you are forming a new entity click here,” then follow the prompts.

- Paper Filing – Complete a Limited Liability Company Certificate of Organization and mail it with payment for the filing fee to the Secretary of the Commonwealth, One Ashburton Place, Room 1717, Boston MA 02108-1512.

Foreign LLC – For an LLC located outside Massachusetts.

- Online Filing – Select “If you are forming a new entity click here,” then follow the prompts.

- Paper Filing – Mail a completed Foreign Limited Liability Company Application for Registration to the Secretary of the Commonwealth, One Ashburton Place, Room 1717, Boston MA 02108-1512. An application must be accompanied by a certificate of legal existence or a certificate of good standing.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3.

Name Reservation

- Filing fee: $30

A name can be reserved for an applicant’s exclusive use for 60 days (M.G.L. Chapter 156D, § 4.02). For an additional $30 fee, the reservation can be extended for another 60 days.

- Paper Filing (Application of Reservation of Name) – A completed application and the filing fee should be mailed or delivered to the Secretary of the Commonwealth, One Ashburton Place, Room 1717, Boston MA 02108-1512. The application must be typed. There is no option in Massachusetts to submit an online application.

Renewing an LLC (Annual Report)

Filing fee: $500

State law requires that every LLC files an annual report before the anniversary date of its registration (§ 12(c)).

- Online Filing – Sign in using the LLC’s Customer ID Number and PIN number, then follow the prompts.

- Paper Filing – Send a signed and completed Limited Liability Company Annual Report form to the Secretary of the Commonwealth, One Ashburton Place, Room 1717, Boston MA 02108-1512.

Dissolving an LLC

Filing fee: $100

An LLC can be terminated through the filing of a certificate of cancellation (§ 14).

- Online Filing – Sign in using the LLC’s Customer ID Number and PIN number, then follow the prompts.

Statutes

“LLC Operating Agreement” Definition

Any written or oral agreement of the members as to the affairs of a limited liability company and the conduct of its business.