A Maine LLC operating agreement is a legal document that sets out how a limited liability company (LLC) registered in Maine will be owned, managed, and operated. The State of Maine requires LLCs to establish and execute operating agreements for every LLC formed.

By Type (2)

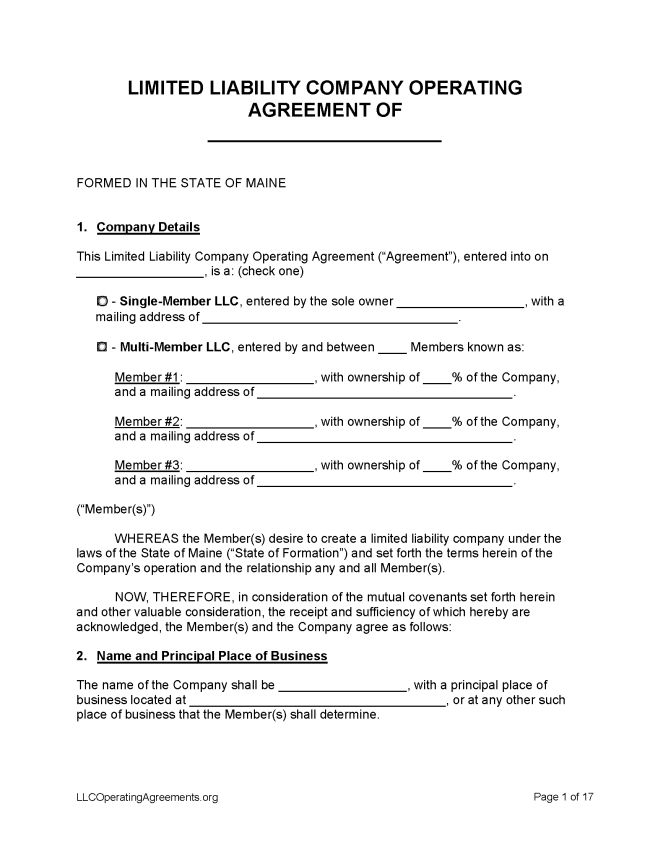

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Maine

- Filing fee: $175 (domestic), $250 (foreign)

- Processing time: 25-30 days

1. Choose a Name

The first step is to reserve the exclusive use of a name for a limited liability company by filing an application with the Office of the Secretary of State (31 MRSA §1509.1). A name can be reserved for up to 120 days.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Maine.

- Paper Filing (Form MLLC-6) – Mail or deliver a completed Certificate of Formation form and payment for the filing fee to Secretary of State Division of Corporations, UCC and Commissions 101 State House Station Augusta, ME 04333-0101.

Foreign LLC – For an LLC located outside Maine.

- Paper Filing (Form MBCA-12) – Mail or deliver a completed Application for Authority to Do Business and payment for the filing fee to Secretary of State Division of Corporations, UCC and Commissions 101 State House Station Augusta, ME 04333-0101.

- Foreign applications must include a Certificate of Existence made not more than 90 days before the lodging of the application.

3. Post-Formation

Once the paperwork has been processed, several documents must be filed.

- LLC Operating Agreement – This agreement will codify the company’s policies, procedures, and plans.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $20

Pursuant to 31 MRSA §1509.1, a name can be reserved for 120 days.

- Paper Filing – Mail a completed Application for Reservation of Name, along with payment for the filing fee, to Secretary of State Division of Corporations, UCC and Commissions 101 State House Station Augusta, ME 04333-0101.

Renewing an LLC (Annual Report)

Filing fee: $85 (domestic), $150 (foreign)

State law requires every LLC to file an annual report with the Secretary of State (§ 1665). The first annual report must be filed between January 1 and June 1 of the year following an LLC’s formation. For example, if an LLC was formed between January 1 and December 31, the first annual report would be due by June 1 of the following year.

- Online Filing – Select “File a Single Annual Report” and follow the prompts.

- Paper Filing – Enter the LLC’s charter number, then select “Create Form.”

Dissolving an LLC

Filing fee: $75

An LLC can be terminated through the filing of a Certificate of Cancellation with the Secretary of State (§ 1533).

- Paper Filing (Form MLLC-11C) – Send a completed Certificate of Termination form and payment for the filing fee to the Department of the Secretary of State Corporations, UCC and Commissions, 101 State House Station, Augusta ME 04333. If using FedEx or UPS, use this address: Department of the Secretary of State Corporations, UCC and Commissions, 111 Sewall Street, 4th Floor, Augusta ME 04330.

Statutes

“Limited Liability Company Agreement” Definition