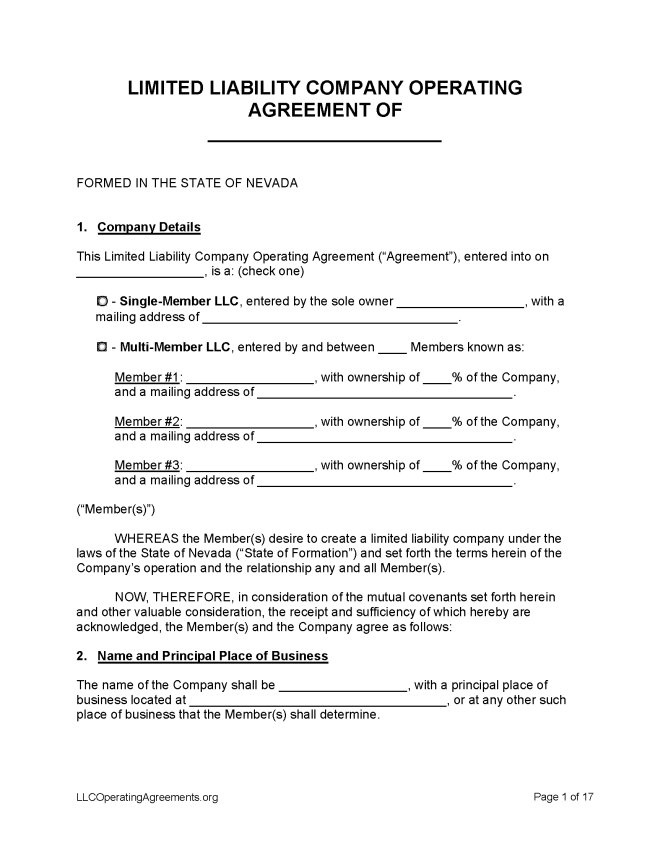

A Nevada LLC operating agreement is a legal document that outlines a limited liability company’s rules, regulations, and policies. The purpose of the agreement establishes the company’s status, thereby protecting its owners from personal liabilities, and clarifies matters so as prevent disputes. Each owner is advised to retain a signed copy of the agreement.

By Type (2)

Single-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Multi-Member LLC Operating Agreement

Table of Contents |

How to Form an LLC in Nevada

- Filing fee: $75

- Processing time: Up to 6 weeks for in-person filings, immediately for online

1. Choose a Name

State law allows a name to be reserved for 90 days for an applicant’s exclusive use. To check whether a name is available for reservation or registration, use the state’s Entity Search.

2. Choose an LLC Type

Domestic LLC – For an LLC located within Nevada.

- Online Filing – Select “Start a Nevada Business (LLC, Corporation, etc.)”, then select “Next.”

- Paper Filing – Mail a completed Articles of Organization form, plus $75, to Secretary of State New Filings Division, 202 North Carson Street, Carson City NV 89701-4201.

Foreign LLC – For an LLC located outside Nevada.

- Online Filing – Select “Qualify a Non-Nevada Entity to do Business in Nevada (Foreign LLC, Foreign Corporation or other),” then select “Next.”

- Paper Filing – Mail a completed Application for Registration of Foreign Limited-Liability Company form, plus $75, to Secretary of State New Filings Division, 202 North Carson Street, Carson City NV 89701-4201.

3. Post-Formation

Once the paperwork has been processed, the next steps are to complete the following forms:

- LLC Operating Agreement – This agreement will outline and clarify the company’s policies, procedures, and ownership structure.

- Federal Employer Identification Number (FEIN) – Select “Apply Online Now” in Step 3. See Publication 15 for a guide to paying tax as an employer in 2022.

Name Reservation

- Filing fee: $25

State statute decrees that a name can be reserved for an applicant’s exclusive use for 90 days before the LLC is formed (§ 86.171).

- Online Filing – Select “Reserve a Name” beneath the “New Business” heading.

- Paper Filing – A Name Reservation Request should be mailed, along with the filing fee, to the Secretary of State New Filings Division, 202 North Carson Street, Carson City NV 89701-4201.

Renewing an LLC (Annual Report)

Filing fee: $150

To renew an LLC each year, per § 86.263, file an Annual or Amended List. This must be filed on or before the last day of the month in which the anniversary date of the LLC’s formation occurs.

- Online Filing – Select “filing for an existing entity/trade name” beneath “Select Filing Type” heading.

- Paper Filing – Mail an Annual or Amended List and State Business License Application plus payment to the Secretary of State New Filings Division, 202 North Carson Street, Carson City NV 89701-4201. Checks are payable to Secretary of State.

Dissolving an LLC

Filing fee: $100

An LLC is dissolved when articles of dissolution are filed with the Secretary of State (NRS 86.541).

- Online Filing – Select “Cancel, Dissolve, Terminate” beneath the “Existing Business” heading, then sign into SilverFlume portal.

- Paper Filing – Mail a completed Certificate of Dissolution/Cancellation plus payment for the filing fee to Secretary of State Commercial Recordings Division, 202 North Carson Street, Carson City NV 89701-4201.

Statutes

“LLC Operating Agreement” Definition

“Operating agreement” means any valid agreement of the members as to the affairs of a limited-liability company and the conduct of its business, whether in any tangible or electronic format.