A multi-member LLC operating agreement binds the owners (members) and establishes how it should be run on a day-to-day basis. Most importantly, it records the ownership between the members of the LLC (by percentage). There are no shares issued in an LLC. The percentage interest mentioned in the operating agreement is a member’s official ownership record.

Notarize (recommended)

It is recommended that a multi-member operating agreement be notarized with each member receiving an authorized copy. If any changes are made to an LLC, the operating agreement should be updated.

Table of Contents |

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

How to Write

Header Information

(1) Name Of Multi-Member Limited Liability Company. The title of this agreement shall require the legal name of the Limited Liability Company this agreement will attach multiple members to. Furnish the name of this Limited Liability Company precisely as it was submitted (and accepted) in its articles of organization to the blank line displayed in the title.

(2) Operating Agreement Effective Date. The date when this agreement begins its effect of obligating each Signature Member to the Limited Liability Company and vice-versa should be displayed in the statement immediately following this agreement’s title.

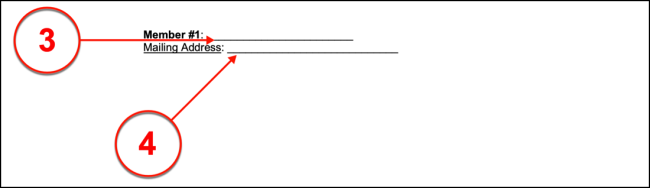

(3) Member Name. Now that the title of this agreement has been completed and its effective date is established, a discussion regarding the Members is required. Begin by presenting the full name of the First Member on the blank line labeled “Member #1.”

(4) Address. The business or mailing address of the First Member being identified must be included in this area. Thus supply the address where Member #1 can reliably receive mail.

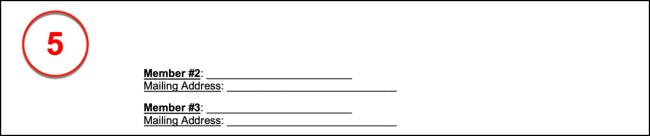

(5) Remaining Members. Enough room has been provided so that up to three Members can be identified however there is no limit to the number of Members that may sign this agreement unless imposed by the State laws of the LLC’s formation. Make sure each additional Member is identified with his or her legal name and mailing address beginning with Member #2, even if additional areas must be inserted to this introduction.

I. Limited Liability Company

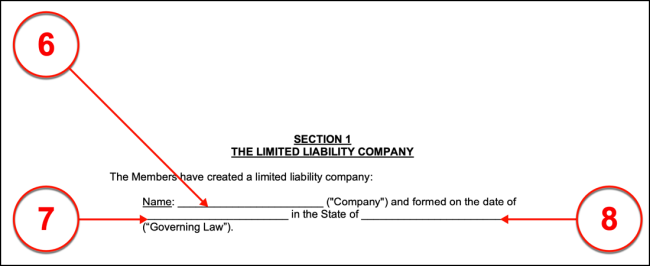

(6) LLC Name. The First Section shall seek to establish some basic facts beginning with the complete name of the Limited Liability Company this agreement will bind the Signature Members to. Produce the legal name of the Limited Liability Company as registered with the State of its formation and presented in the title above.

(7) Date Of Formation. Report the calendar date when the Limited Liability Company’s articles of organization were formally completed and filed.

(8) State Of Formation. The name of the State where the Limited Liability Company officially formed must be submitted to the empty line preceding the term “(“Governing Law”).”

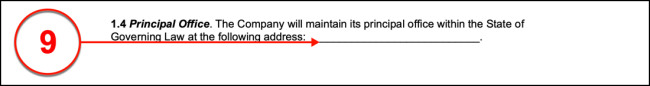

(9) Principal Office Address. The physical address of the Limited Liability Company’s Principal Office must be documented in this agreement. Furnish this address to the space provided by Section 1.4.

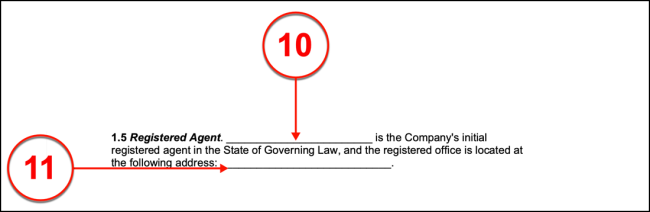

(10) Registered Agent Name. The name of the Registered Agent who has agreed to receive all formal court-generated documents and official notices being served to the Limited Liability Company must be dispensed to the first empty space displayed in Section 1.5.

(11) Registered Agent Address. The registered address of the Agent above should be documented on the second blank line in Section 1.5.

(12) Schedule 1 Information. The first section shall also call for the development of an attachment titled “Schedule 1.” This will be observed in a future item. Review this area in preparation for completing this attachment. It should be mentioned that all Members participating in the Limited Liability Company will need to submit their signature to the “Schedule 1” attachment in addition to signing this agreement.

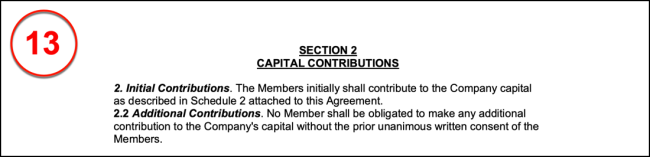

II. Capital Contributions

(13) Schedule 2 Report. As per Section 2, this agreement shall seek the additional attachment “Listing Of Capital Contributions – Schedule 2.” The information called for on this attachment by these sections will require a record of each Member’s contribution to the Limited Liability Company. Each Member named in this attachment should be prepared to sign it upon its completion with this paperwork. It should be mentioned that Schedule 2 will also be referred to in the future of this agreement, therefore make sure the information supplied to it is accurate.

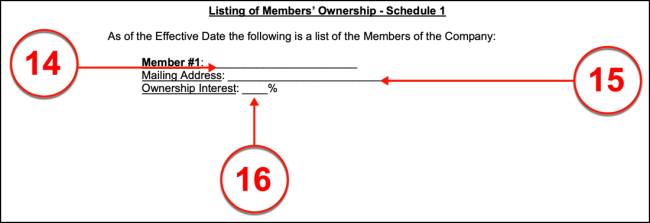

Schedule 1 Listing Of Members’ Ownership

(14) Identifying Members On Schedule 1. Schedule 1, found at the end of this agreement, must be completed and signed then attached to this paperwork before it is executed. Each Member being bound to the Limited Liability Company through this agreement must be identified. Begin with the First Member named in Section 1. His or her name must be reproduced on the “Member #1” line exactly as it was reported in the First Section. As with the First Section, the areas required to record the identity and required information for up to three Members are available for this task however, if there are more than three Members signing this agreement, insert additional areas to this Schedule and provide the full name of each Member. If there are less than three Members, then the unneeded areas may be left blank, crossed out, or removed altogether.

(15) Member Address. The Address of each Member must be supplied to the “Member Address” line directly below his or her name.

(16) Ownership Interest. The portion or percent of the Limited Liability Company that a Member owns must be dispensed with his or her name and address in Schedule 1. Document the exact percentage of ownership in the Limited Liability Company each Member enjoys in his or her respective areas.

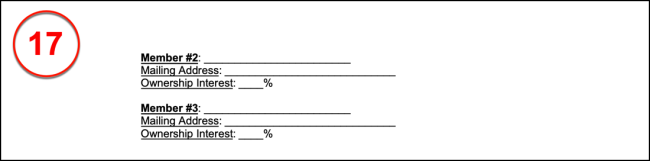

(17) Ownership Interest Of Remaining Members. The Members in Section 1 must all have their full name supplied to Schedule 1 with their mailing address and percentage of ownership. Areas have been supplied for two additional Members (Member #2 and Member #3). Since each Member must have this information presented to this attachment, more than three Members will require additional areas inserted to this attachment so that a complete report may be furnished.

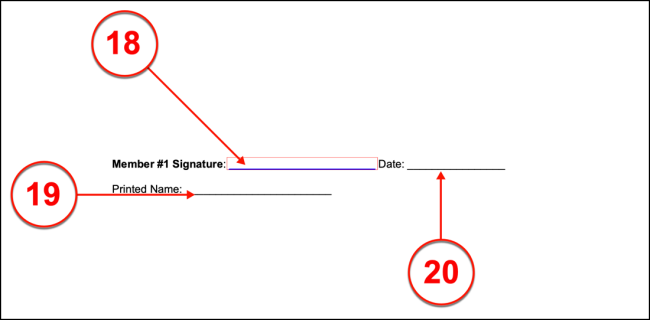

(18) Member 1 Signature. The first Member named in Schedule 1 must sign his or her name to the “Member #1 Signature” line.

(19) Full Name. Member #1 must also print his or her name on the “Printed Name” name line.

(20) Member #1 Signature Date. Once Member #1 has signed and documented his or her name, he or she must submit the current date to the remaining space in the “Member #1 Signature” section.

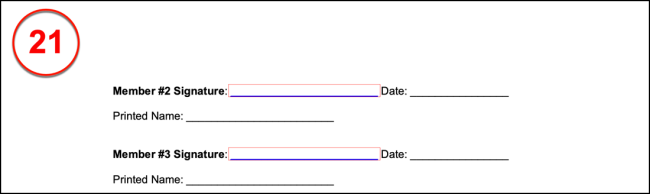

(21) Member 2 Signature. Each Member named in Section 1 and above in this Schedule must provide his or her signature, printed name, and signature date. Make sure to remain consistent in the order that the signatures are presented. For instance, the Second Member named in Section 1 should be Member #2 and so on. By default three signature areas are available however, additional signature areas may be inserted as needed.

Schedule 2 Listing Capital Contributions

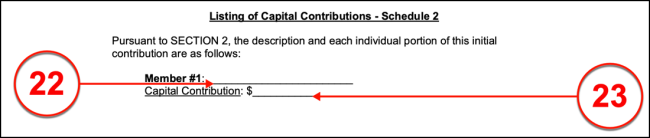

(22) Identifying Members On Schedule 2. The First Member established in Section 1 and Schedule 1 should be named in Schedule 2 on the line labeled “Member # 1”

(23) Capital Contribution. The amount of money that was required by Member #1 should be recorded as his or her “Capital Contribution” on the next available line. In some cases, physical property (i.e. equipment, vehicles, etc.) may have been contributed by the Member. If so, then the value of such contributions should be included in the figure recorded.

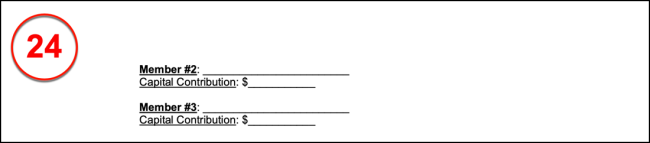

(24) Remaining Members’ Capital Contribution. A second and third area have been supplied in Schedule 2 so that the name and “Capital Contribution” of Member #2 and Member #3 can be documented. Every Member identified in the First Section should have his or her full name and the contribution he or she made recorded. Remember, the dollar amount recorded as a Member’s contribution must accurately present the full value he or she contributed. This includes the payment or purchase for physical items obtained purely for the LLC or donated to the LLC by the Member being discussed. More areas may be inserted as needed.

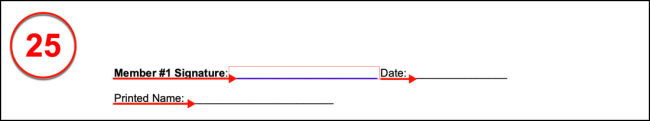

(25) Member 1 Signature. The First Member mentioned in Schedule 2 must sign his or her name on the line labeled “Member #1 Signature” and print his or her name on the “Printed Name” line below. Additionally, Member #1 must establish the day of his or her acknowledgment of the information in this schedule by documenting the date when he or she executed this signature.

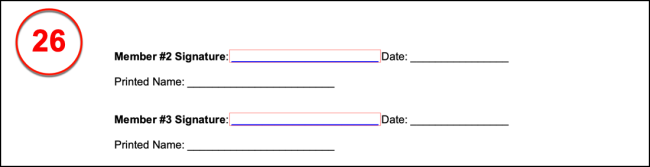

(26) Member 2 Signature. As with the First Schedule, each Member mentioned in Schedule 2 must provide his or her signed and printed name and then document his or her respective date of signing. Two additional signature areas (“Member #2 Signature” and “Member #3 Signature”) are available however,more signature areas (that are properly labeled) may be inserted if necessary.

Multi-Member Agreement Execution

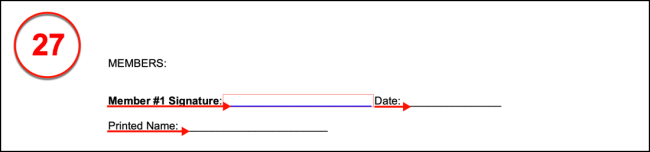

(27) Member 1 Signature. Member #1 from Section 1 should review all the conditions this agreement requires followed as well as the information supplied to Schedules 1 and 2. Upon satisfaction, Member # 1 must sign the “Member #1 Signature” line, print his or her name, and deliver the date when he or she submitted his or her binding signature.

(28) Remaining Signature Requirements. Two additional areas are presented so that Member #2 and Member #3 may each sign and print their names as well as deliver their respective signature dates. Therefore, the next Member whose signature should be submitted at the end of this document must be Member # 2. His or her signature, printed name, and signature date will be required in the area beginning with the “Member #2 Signature.” If there are more than two Members, make sure each one reads this paperwork, reviews the attached schedules, then fulfills the signature requirements of this agreement. If more signature areas will be needed to accommodate additional Members, then make sure that each one signs his or her name in a manner that is consistent with the order he or she was named in Section 1.