A single-member LLC operating agreement is a document that verifies one party to be the sole owner of a company. An agreement should also include the rules, management, and when meetings of the company will be scheduled.

For a single-member LLC, an operating agreement proves that the company is its own entity and separate from the individual owner. Therefore, if the owner is ever sued or liable for something the company owns, the owner can claim that the exposure is limited to the LLC.

Signing

It is highly recommended that the owner sign the operating agreement immediately after the formation of the LLC. In addition, it should be electronically signed or notarized to prove the date and time of authorization. This will prove that the agreement has existed for a significant period of time and wasn’t drawn together quickly before a request by a 3rd party.

Table of Contents |

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

What is a Single-Member LLC?

A single-member LLC is a company that has one owner and is treated as a “disregarded entity” by the IRS. The main purpose of a single-member LLC is to isolate the liabilities of a business to the entity only. Therefore, any legal or financial exposure is limited to the LLC’s assets.

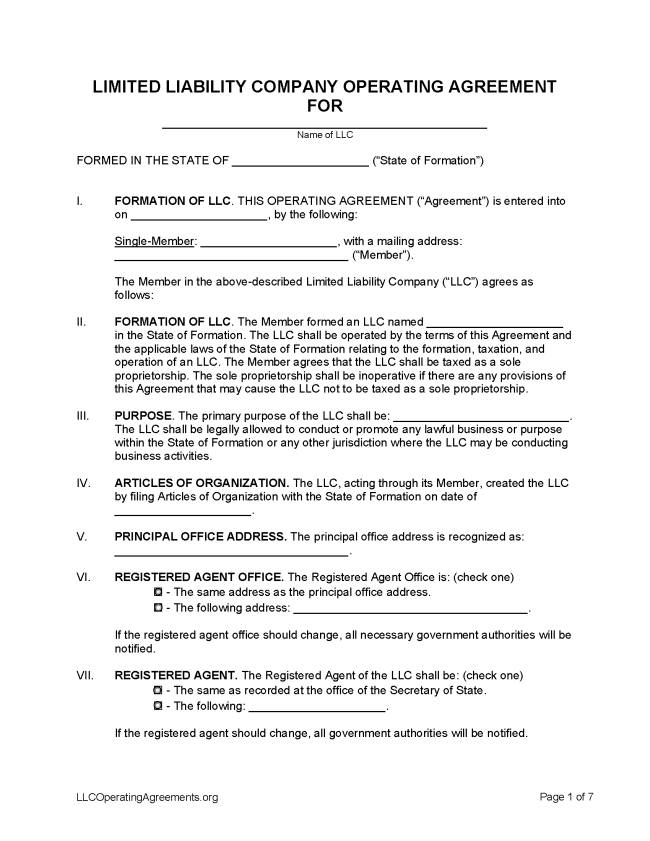

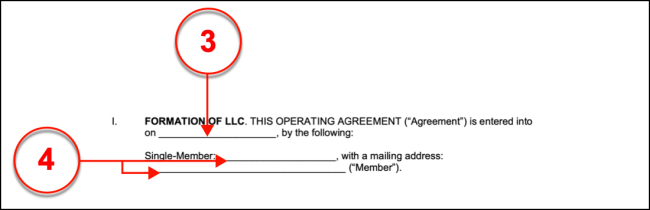

How to Write

Download: Adobe PDF, MS Word

Introductory Information

(1) Name Of LLC. Before attending to the First Article with requested information, locate the title of this agreement, then furnish the legal name of the Limited Liability Company this agreement will concern to the empty line.

(2) Formed In State. Produce the name of the State where the Limited Liability Company named was officially formed.

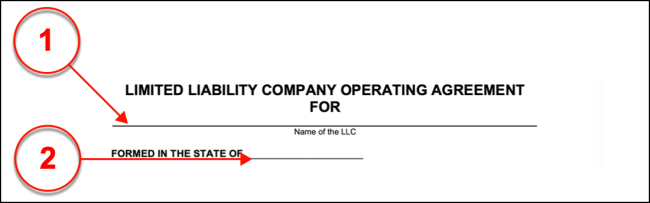

I. Formation Of LLC

(3) Date Of Agreement. The calendar date that marks when the agreement currently being worked on will be effective upon the LLC Member and the Limited Liability Company named above must be recorded on the first available space of the First Article.

(4) Single Member Identity And Address. The Single Member of the Limited Liability Company who shall execute this agreement as an acceptance of its conditions and terms must be identified as such. This requires his or her name to be recorded on the line labeled “Single-Member” and his or her address to be submitted to the next available space.

II. Formation Of LLC

(5) Name Of LLC. The legal name of the Limited Liability Company that the Single Member shall engage this agreement with should be presented on the first line of the Second Article while the state where it was formed should be identified on the line that follows.

III. Purpose

(6) Goals Of Operation. In order for a concrete agreement to be developed between a Limited Liability Company and its Single Member, a discussion on why the Limited Liability Company formed or the purpose for its operation should be completed. Use the space in the Third Article of this agreement to document the purpose of the LLC’s formation and current operation. For instance, the LLC may be a for-profit production company whose goal is to sell media (i.e. movies, music, etc.) to the public, and engage in other legal business activities for profit. In most cases, it would be wise to refer to the Limited Liability Company’s original articles of organization for this information.

IV. Article Of Organization

(7) Date Of Submitted Articles Of Organization. The calendar date when the Limited Liability Company’s articles of organization were accepted by the State where it formed should be reported in the Fourth Article where requested.

V. Principal Office Address

(8) Main Business Address. Supply the address of the Limited Liability Company’s principal office as it is registered with the State where it was formed.

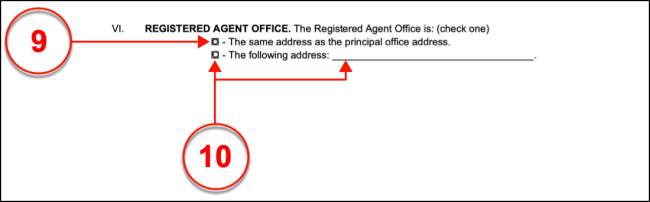

VI. Registered Agent Office

(9) Principal Office Address. If the Registered Agent for the Limited Liability Company will receive served documents at the Limited Liability Company’s principal office address and has filed this address with the State where he or she will receive notices on behalf of the LLC, then select the first checkbox from Article VI.

(10) Separate Registered Agent Address. If the Limited Liability Company’s Registered Agent must receive official paperwork or process (i.e. notices, court orders, etc.) aimed at the Limited Liability Company at an address other than the principal office of the Limited Liability Company, then the second checkbox must be selected from Article VI. Once this checkbox is marked, the address where the Limited Liability Company’s Registered Agent can be reached should be dispensed to the space provided by this option. Bear in mind this address must be documented precisely as it was filed with the State by the Limited Liability Company’s Registered Agent, therefore, this must be a physical address and not a P.O. Box.

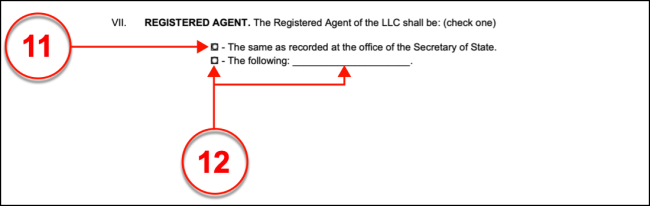

VII. Registered Agent

(11) On File With Secretary Of State. If the Registered Agent of the Limited Liability Company has been recorded with the Secretary of State then, mark the first checkbox available in the Seventh Article.

(12) Registered Agent Identity. If the Registered Agent obtained by the Limited Liability Company is not currently associated with the concerned LLC in the eyes of the State then select the second checkbox. Once done, produce the full name of the Party who shall act as the Limited Liability Company’s Registered Agent as per this agreement. In such a case, it is often advised, that the credentials of the Registered Agent are verified and that his or her intent to act in this role is well established before completing this section.

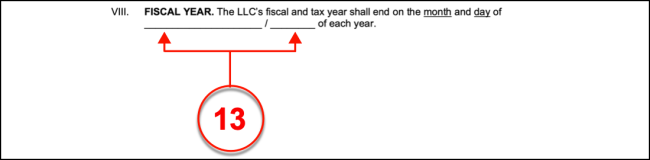

VIII. Fiscal Year

(13) First Date Of LLC Fiscal Year. The month and the year marking the first day of the Limited Liability Company’s official fiscal year and tax year must be documented using the formatted spaces in Article Eight.

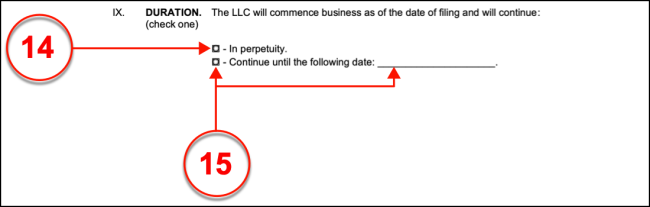

IX. Duration

(14) In Perpetuity. If the Single Member Limited Liability Company will continue its operation indefinitely then select the “In Perpetuity” checkbox option presented in the Ninth Article.

(15) Until termination Date. If the Single Member Liability Company being discussed will only have a limited lifespan, meaning that it intends to dissolve in the future, then the second checkbox in Article Nine must be marked and the intended date of termination (of the LLC) must be reported.

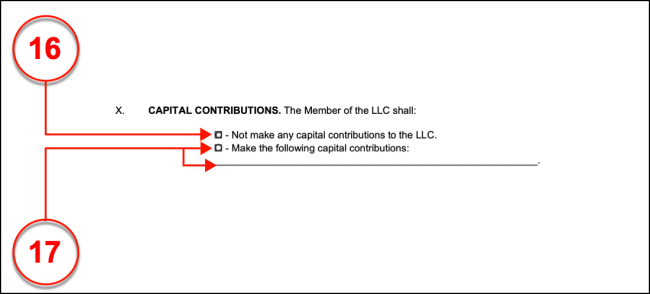

X. Capital Contributions

(16) No Capital Contributions Required. If the Single Member behind this agreement was not required to make any capital contributions to the Limited Liability Company being discussed, then the first checkbox in Article Ten must be marked.

(17) Member Required Capital Contributions. Place a mark in the second checkbox of Article Ten if the Limited Liability Company required capital contributions from the Single Member and present these contributions in the space provided. Make sure this is a complete record that includes the value of any machinery contributed to the business.

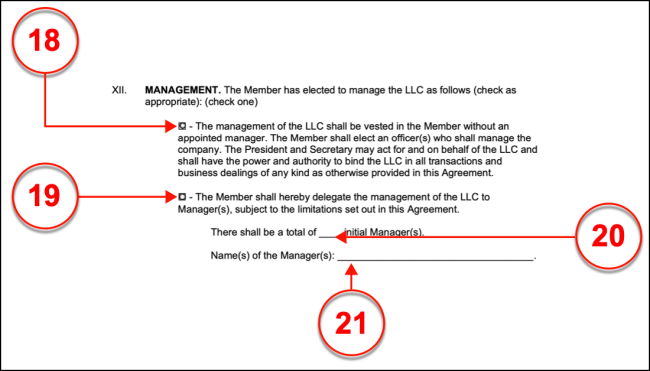

XII. Management

(18) Single Member Manager. If the Single Member defined in the First Article will be named as the Sole Manager of the Limited Liability Company, then mark the first checkbox available in Article XII.

(19) Designated Manager(s). If the Single Member intends to name separate Managers to operate the Limited Liability Company then mark the second checkbox presented in the Twelfth Article.

(20) Initial Managers. If the second checkbox has been selected from the Twelfth Article then the number of managers that the Single Member will initially appoint to the Limited Liability Company must be reported to complete this option’s definition.

(21) Manager Identity. In addition to the number of Managers who shall be appointed by the Single Member, the name of each of these Managers must be submitted to the final empty space displayed by this option.

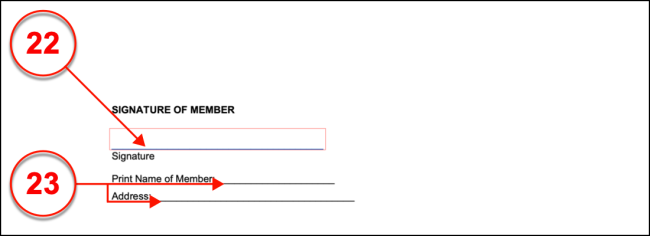

XIII. Signature Of Member

(22) Signature. Once the information has been completed and verified as accurate by the Single Member named in the First Article, he or she will need to prove his or her intent to accept the conditions of this agreement for its lifespan by signing the “Signature” line provided at this agreement’s closing.

(23) Printed Name And Address. The full name and residential address of the Single Member must be submitted in print after he or she has signed this document.